This week we have received first confirmations that some global oil demand indicators have appeared to reach bottom.

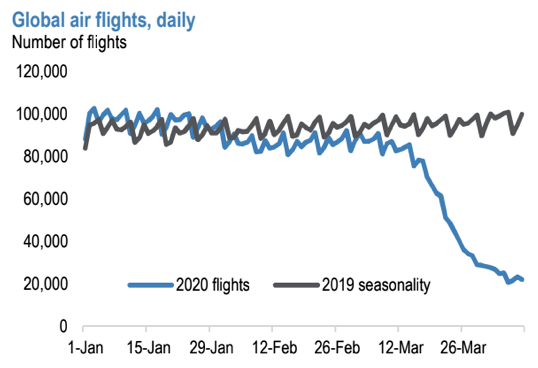

Global flights tracked by FlightAware have bottomed last week. This appears to be driven by a combination of flight activity reaching a bottom at very low levels in Europe and some stability in the number of daily flights out of the US. We still see no improvement from China, where daily flights continue to track 60% below last year’s level.

Global rush hour road travel times from TomTom.com appear to have bottomed at the end of Mach and has been showing tentative signs of improvement since then (latest data point for April 1).

On the supply side, shut-ins are picking up pace. We track 1.36 of outages in April related to COVID-19, storage constraints and low oil prices. Out of that 325 kbd will be curtailed in Canadian oil sands, with Iraq and the US adding another 300 kbd each. In Venezuela, about 235 kbd will likely be taken off line in April given the export restrictions and limited storage space. Brazil accounts for 200 kbd.

Moreover, OPEC agreed during the last weekend to reduce oil output by 9.7mn bpd for May-June, the biggest cut ever. In a knee-jerk reaction, oil prices opened higher early today but failed to embark on a sustained upward trend amid worries that the agreement will fall short of completely offsetting the estimated drop in global fuel consumption.

Given limited storage capacity, markets will need to price the reality that production will eventually have to be reduced or even shuttered. Widespread US light tight oil shut-ins will not occur until WTI prices plunge below $10-15 per barrel, but modest impacts could be visible as soon as WTI falls below $20/bbl.

Hence, we advocated shorts in CME WTI futures contracts of far-month tenors with a view to arresting any further dips, since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for May month deliveries on hedging grounds. Courtesy: JPM

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings