The dichotomy between FX vol pricing and market price action continues, as the risk-off market from the end of the last week extended into this week, as news over a further spreading of the Coronavirus broke over the weekend: on Monday/Thursday, Equity Indices and EM Currencies suffered heavily on the latest news, yet FX vols failed to display any aggressive repricing.

Under such circumstance, we propose two types of solutions for expressing defensive positions, one via low-premium directional USD/Asia trades, the other via Carry positive delta-hedged riskies constructs.

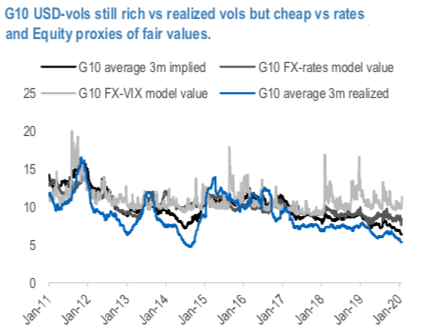

A couple of observations regarding current pricing of vols against market factors are presented (refer 1stdiagram). The chart displays how, at least for G10 USD vols, current vol levels still command on average a premium vs realized vols, while appearing as cheap vs two cross-asset fair value analyses (vs Rates and Equity vols).

Previous research (Tactical theta collecting via delta-hedged risk off ratio spreads in MXN and CAD) discussed how, as of late, FX spot variables have recently displayed a more contained sensitivity to a set of well-known global market factors, de facto capping the potential for a repricing of FX vol levels themselves.

Perhaps surprisingly (and for sure controversially), our tactical indicator for FX short-Gamma trades still points to a conducive environment for capturing Theta from the front-end of vol curves (refer top chart in the 2nd diagram), with latest average signal suggesting to trade 98% of the max Vega notional allowed.

After a successful 2019 (benchmark portfolio at +12.0%), short-Gamma has started well 2020, delivering a positive PnL even over the past week (+0.5% for passive/filtered strategies), which is consistent with a contained reaction of the FX market as a whole to the generalized fears induced by a possible widespread diffusion of the Coronavirus.

Taking into account these patterns, absent a structural factor triggering an inversion of the latter dynamics, it is not easy to call for a rebound of Gamma performance for “pure volatility” trades.

Overall, it summarizes the disconnect between global markets and FX vol pricing continues, with the latter displaying little reaction to the risk that Coronavirus could turn into a world epidemic.

On the back of attractive pricing, long skews and correlations USD/Asia constructs offer a cheap solution for expressing Coronavirus hedges in a directional format.

Long USD skews and correlations, therefore, offer a cheap entry point for hedging the emergence of the Coronavirus as a global epidemics and a factor capable of upsetting the risk-loving narrative markets had enjoyed since end of last year. Rather than expressing the hedges as pure vol plays, some of which have been already discussed, we prefer considering two low-premium / high-payout structures that benefit from current market parameters. This tactically guides in favoring short-dated Expiries (1M).

Consider: 1M At-Expiry-Digital (USDINR >2% OTMS; USDKRW >2% OTMS; USDSGD >2% OTMS) call @ 2.8/4.8% indicative.

1M ATMS worst-of basket USD ATM call on (USDINR, USDKRW, USDSGD) @ 0.225/0.275% indicative. Courtesy: JPM

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis