Today, the Bank of Japan has maintained the status quo, negative rates are kept on hold. The BoJ cut its GDP forecast for FY2018 ending in March from 0.9% to 0.6%, which is no surprise considering what looks like a weak Q1. In addition, FY2019 and 2020 GDP and inflation forecasts have been cut slightly. Particularly interesting is the new inflation outlook, which now includes FY2021. BoJ expects CPI inflation to hit 1.6% by then (lowest t+2 inflation forecast since 2013). That is, the BoJ does not expect to meet its inflation mandate within a two to three-year horizon.

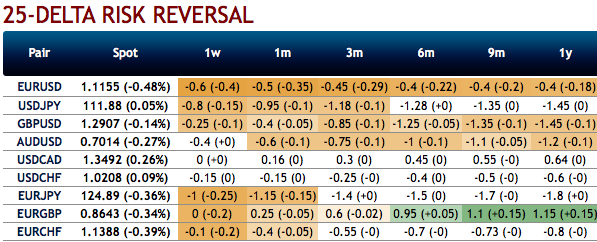

Risk Reversals Substantiate Skews (EURJPY): We could see the existing bearish neutral risk reversal set-up of euro crosses (especially EURJPY and EURUSD) that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is a noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

Hedging skewness (EURJPY): Most importantly, to substantiate the above indications, please be noted that the positively skewed IVs of 3m tenors that are also signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors expect that the underlying spot FX likely to break below 122.50 levels so that OTM instruments would expire in-the-money.

Options Trade Recommendation (EURJPY): We’ve advocated buying 3m EURJPY (1%) ITM -0.69 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier. If the expiry is not near, the delta movement wouldn’t be 1-point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money put option with a very strong delta will move in tandem with the underlying. Source: Sentrix and Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -47 levels (which is bearish), while hourly JPY spot index was at 160 (bullish) while articulating at (07:22 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation