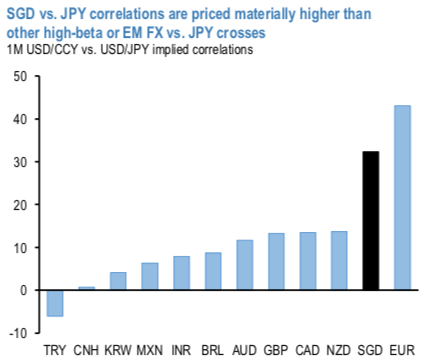

SGD vs. JPY correlations are priced materially higher than other high-beta or EM FX vs. JPY crosses on the escalation in trade tensions, Chinese retaliation with tariffs and Brexit dust with no-deal negotiation.

USDSGD vs USDJPY: Yen-cross gamma has performed like a charm over the past few weeks, most notably during the rush for exit doors on risk sparked by the break of USDCNY through 7.0, followed by the equally volatile retracement shortly after the announcement of delayed/split tariffs.

Options markets have accordingly re-priced USDJPY vs. USD/high-beta implied correlations lower / high-beta cross-yen vols higher e.g. even after this week’s partial retracement, AUD vs. JPY 1M implied corrs (+12%) are more than 20% pts. below their late-July high.

One yen-cross that defies this general rule is SGD/JPY. While the broad contours of the cross have tracked those of the rest of the JPY bloc, absolute levels of corr. are much higher (refer above chart) that make them ripe for option structures that benefit from de-coupling. Arguably, no JPY-cross correlation should be priced in positive territory in the current climate of recessionary fears, let alone in the mid-30s, and certainly not when trailing realized corrs are deeply negative (hourly 1-wk -9%, 4-wk -40%). The case for a stronger Yen in a falling US real yield, jittery risk climate is obvious; the case for a weaker SGD rests on Singapore’s high degree of exposure to the US/China trade conflict and expectations of impending MAS easing in October that informs the Asia team’s short SGD NEER stance.

Consider the following dual digital structure: 3M (USDSGD > 1% OTMS, USDJPY < 1% OTMS) costs 10% (individual digitals 26% and 37.3% respectively). Courtesy: JPM

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data