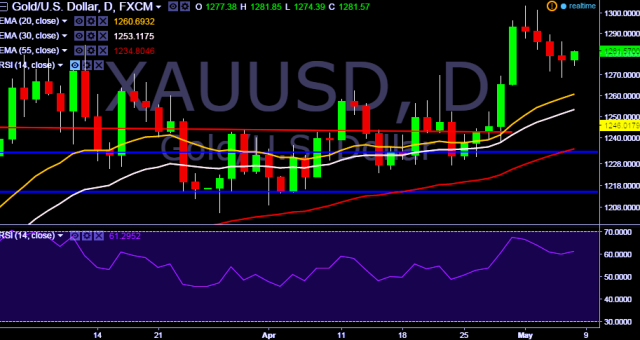

- XAU/USD is currently trading around $1278 mark.

- It made intraday high at $1280 and low at $1274 levels.

- Intraday bias remains bullish till the time pair holds immediate support at $1268 marks.

- A daily close above $1282 will take the parity up towards $1292, $1296, $1303, $1315 and $1327 marks respectively.

- Alternatively, reversal from $1303 will drag the parity down towards key support levels at $1275, $1272, $1268 and $1252 marks respectively.

- The ADP job data released on Wednesday with lower than expected numbers to 156,000 m/m vs 194,000 jobs m/m previous release.

- Today U.S will release NFP job results. Markets expect non-farm payroll to show 203k growth in jobs in April. Unemployment rate is expected to be unchanged at 5.00% while average hourly earnings are expected to show 0.3% mom growth.

We prefer to take long position in XAU/USD only above $1282, stop loss $1268 and target $1303/ $1310 marks.