As expected by the majority of analysts the Fed did not raise interest rates in the last policy meeting. As a result, it therefore, seems to make sense that investors seeking after safe avenues of investments in Gold, evidently this precious metal is trading slightly higher this morning.

In addition, the U.S. central bank cut the number of rate hikes it expects this year to one from two during this Christmas and projected a less aggressive rise in interest rates next year and in 2018.

Well, until then we believe that safe-haven demand strengthened in bullion markets after the BoE chose to be aggressive in its monetary policy by easing 25 bps, defying market expectations for additional monetary easing.

Hedging framework:

You can observe our beliefs that have been factored ETFs and OTC bullion market functionality.

ETF holdings increased in July by 2.8% - the sixth monthly increase this year. YTD total ETF gold holdings are up 37.4% (17.5 million ounces) and are at the highest levels since mid-2013.

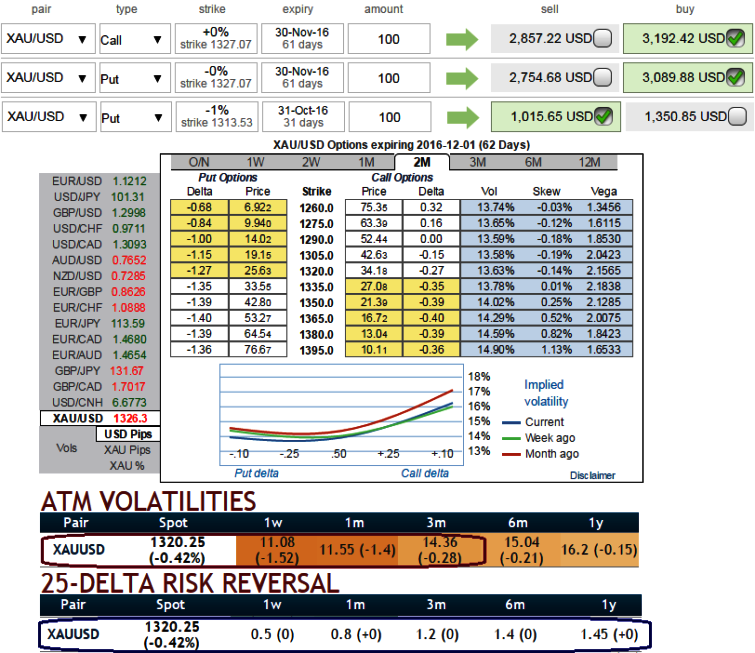

Currently, the implied volatility of XAUUSD ATM contracts across all timeframes reducing significantly (good news for option writers), and is a tad below 11.10%, while the skews in these IVs signify the OTC market interest in OTM call strikes (good news for put writers).

While, risk reversals also continue signalling upside risks, considering above fundamental developments in bullion markets we think the opportunity lies in writing an OTM put in next 1 months time for sure while formulating below strategy for gold's fluctuation so as to reduce the net hedging cost.

Strategy: 3-Way Options straddle versus Put

Spread ratio: (Long 1: Long 1: Short 1)

Rationale:

Bidding 1m risk reversals match the IV skews.

As stated above bullion market remains safe-haven demand especially strengthened especially after the Fed and BoE policy cycles that keep us eye on shorting expensive puts with shorter expiries.

As a result, we capitalize on such beneficial instruments with cost effectiveness.

The execution:

Contemplating above aspects, good to initiate long in XAUUSD 2M At the money delta put, go long 2M at the money delta call and simultaneously, short 1M (1%) out of the money put with positive theta.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty