Long vega priced well in NZD, CHF and SGD: Amid heightened sensitivity of macro markets to US inflation data and increasing discomfort about the twin US deficits FX vols should remain supported. FX vol ownership at belly of vol curve is particularly appealing.

We backtested a rule-based heuristics to owning long vega –i.e. systematically rotating long vega ownership across USD/G10 & EM based on a composite trading signal -constructed from three signals: 1-year z-score of CTP (carry to-premium ratio), the strength of spot trend and 1-year z-score of realized/ATM vol ratio. The rule-based trading made long vega worth sustaining 3-5 vol pts of theta-decay annually, on average, in calm markets.

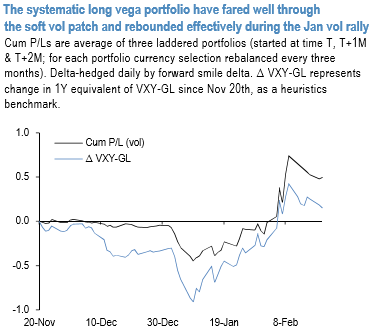

The above chart shows the recent (out-of-sample) performance of the strategy. The systematic portfolio (three 1Y tenor straddles selected monthly and held for three months in laddered portfolios started at time T, T+1M & T+2M) have fared well through the December soft vol patch and rebounded effectively during the January vol rally.

In the current market, the three vega longs that stand out based on the composite systematic signal are NZD, CHF and SGD vols. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data