GBPUSD after pulling back from recent peaks of 1.3514, the pair has regained the buying momentum. The minor trend has taken trend line support at 1.2904 levels and spikes above 7 & 21-DMAs. On the balance, the structural setup for 2020 looks slightly negative for the USD early on. In the near term, analysts prefer to sell USD on rallies on the back of risk-on sentiment and a bearish technical setup. For now, we prefer to express a higher GBPUSD, EURUSD and AUDUSD. Meanwhile, the USDJPY we think may be clamped in by positive risk sentiment on one end, and a weaker USD on the other, leaving an overall range-bound posture.

The most bullish scenario for GBP given our assessment of these issues is likely to be a large Conservative majority, in line with the opinion polls. Yes this would deliver Brexit but Johnson would have the political wiggle room to dilute the relatively hard Brexit currently envisaged in the political declaration.

GBP's REER is cheap, 11% vs a 20Y average, but delivery of Brexit won't eliminate the bulk of the undervaluation. Much of this is as a consequence of the UK's worst-in-class current account deficit.

Central to the debate about GBP's prospective upside on a deal is the extent to which investors are U/W UK assets and over-hedged on GBP. We are cautious in assuming massive short-covering as visibility over aggregate position is low, while certain key investors such as reserve managers most definitely are not U/W.

GBP headroom is capped as investors have no clarity about the most important issue that will determine the economic consequences of Brexit - the future trade deal - albeit Johnson’s WA envisages a looser set of arrangements than May’s ill-fated deal.

Moreover, there is still the risk of an economic cliff- edge at the end of 2020 if Johnson honours his commitment not to extend the one-year transition.

Our assumption is that Brexit is the dominant issue for markets and so broader economic policies will be secondary for the exchange rate. GBP will likely take its directional cue from the read-through to Brexit whereas the size of the move will be augmented or moderated by the government’s broader policy platform.

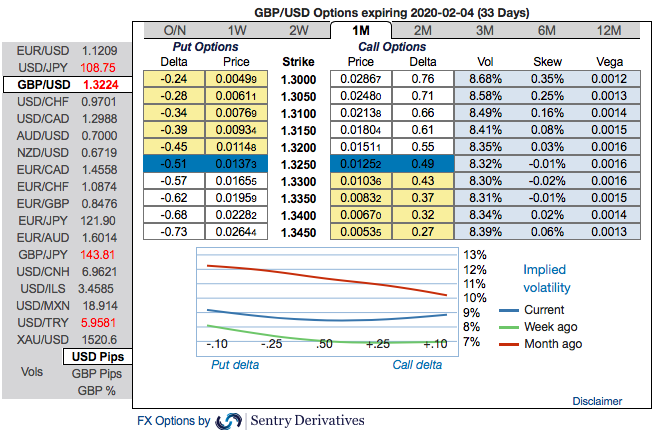

Strategy (Debit Put Spread): Contemplating above factors, wise to deploy diagonal options strategy by adding short sterling via a limited loss tail hedge: Stay short a 1M/3W GBPUSD bear put spread (1.3425/1.27), spot reference: 1.3205 level.

The Rationale: Observe the 1m skews that has stretched on both the sides, hedgers have shown interests on both OTM Calls and OTM Put options. While the positively skewed implied volatilities of 3m tenors have still stretched towards OTM put strikes that indicates the hedging sentiments for the downside risks amid the minor upswings.

To substantiate the downside risk sentiment, risk reversal numbers have still been signalling bearish hedging sentiments. Hence, we advocate the diagonal options strategy on both hedging and trading grounds.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed