Will there be a hard Brexit on October 31st? Ultimately, this will probably depend on whether Prime Minister Johnson and his government really want to leave the EU at all costs. By making full use of all the discretionary leeway – which, in the absence of a constitution, is quite large in Britain – and by disregarding many democratic conventions, they could probably prevent Parliament from intervening and preventing a hard Brexit. This means that the risk of a no-deal Brexit has risen recently, and uncertainty is likely to continue to weigh on the British pound in the coming weeks.

Whether it’s hard Brexit or not, the pound remains under pressure. But one thing is certain, precisely because of the many unresolved legal issues, there would be a great deal of uncertainty about further developments in the coming weeks. Against this backdrop, the Pound is likely to remain weak.

If we do really see a no-deal Brexit at the end of October we might well encounter a further 10% GBP depreciation - possibly even more, as a sudden pronounced slide can easily become self-reinforcing in the FX market’s current state (that can create flash crashes even out of nowhere).

However, a scenario such as that can easily create countermoves as well. First of all BoE and ECB might detect “disorderly markets” and might intervene (consistent with their principal commitment to market-driven exchange rates). Secondly, as extremely pessimistic forecasts about the immediate consequences of a no-deal Brexit (shortages in food supply etc.) are probably exaggerated the FX market might soon be dominated by a “well it wasn’t that bad after all” mood following 31 October, which would disregard the negative medium to long term effects of Brexit. Let’s now quickly glance at OTC outlook and suitable strategy for GBPUSD swings.

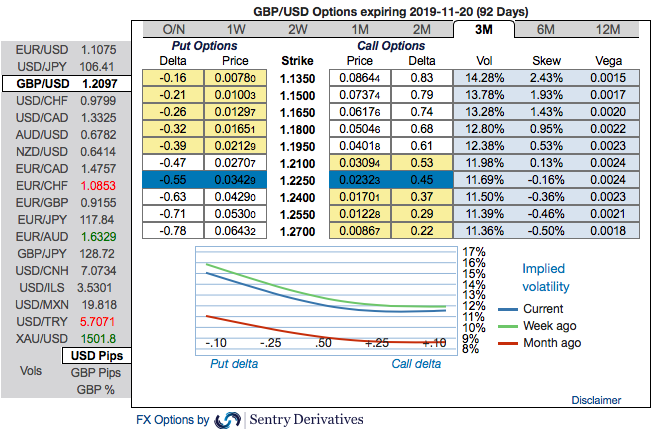

OTC outlook: The positively skewed implied volatilities of 3m tenors have still stretched towards OTM put strikes. To substantiate the downside risk sentiment, risk reversals have still been signaling bearish hedging sentiments, although some positive shift is observed in the bearish risk reversal numbers across 1m-3m tenors.

From the GBP OTC outlook, amid major downtrend we reckon that the sterling should not suffer like before, but, one should not disregard the Brexit settlement risks on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favorable result of the Brexit process.

In case of a renewed postponement of the Brexit date, a significant recovery of Sterling has to be expected, as a no-deal scenario would then once again become less likely. In principle, early elections would open up the possibility of a moderate new government and a constructive Brexit (or even Brexit being canceled).

Stay short sterling via a limited loss tail hedge: Stay short a 2M GBPUSD 30d/10d bear put spread on August 2nd(spot reference: 1.2088 level). Paid 0.66%. Marked at +0.74%. Courtesy: Sentrix, Saxo & Commerzbank

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes