UK currency dropped to the day’s lows against the dollar today as the UK consumer price inflation eased to 3 percent in December 2017 from a near six-year high of 3.1 percent in the previous month, as widely expected. Prices rose at a softer pace for transport, recreation and culture, housing and utilities, and food and non-alcoholic beverages.

While Brexit continues to dominate GBP, which is not unreasonable as there is a risk premium of between 10% (cyclical) and 15% (structural) for the long-term consequences of Brexit. This risk premium would be excessive if the UK were to secure a good outturn (a new trade deal tantamount to a permanent stand-still arrangement), yet inadequate in the event of a non-negotiated Brexit.

This process therefore still has the potential to drive large and potentially abrupt movements in GBP, albeit this shouldn’t completely overshadow more prosaic fundamentals. And on this front, conditions have moderately deteriorated for GBP as the UK economy is being left behind as the ROW powers ahead.

This is most notably the case for EURGBP as the Euro area economy is set to out-grow the UK for three consecutive years. The impact on GBP of this chronic, economic underperformance has been masked by the tightening in BoE policy (we expect two more hikes this year, the market one), but we continue to regard this rate cycle as being inherently bad news insofar as it reflects high inflation yet low growth. We do not believe it will sponsor the 6-7% appreciation in GBP typically associated with a hiking cycle.

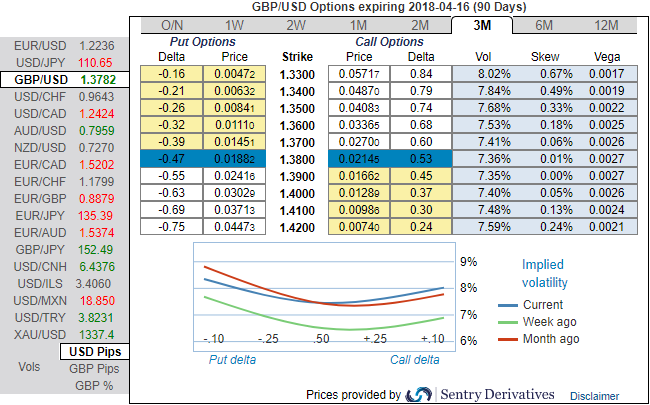

OTC indications (GBPUSD):

Let’s glance at sensitivity tool, the positive shift in risks reversals in shorter tenors indicates the momentary bullish risks in underlying spot FX prices, while long-term bearish hedging sentiments remain intact. This is justifiable as we've had the considerable bearish major trend since July 2014 prior to the prevailing consolidation phase.

Positively skewed IVs of 3m tenors have been well balanced that signifies the hedging interests on both OTM put/call strikes that means the ATM instruments have the higher likelihood of expiring in-the-money, while balanced hedging sentiments on either side in comparatively shorter tenors are favorable to both call and put options holders’ advantages.

Whereas the 6m skews have still been indicating bearish risks, this stance is substantiated by the bearish neutral risk reversals that indicate hedgers still bid for downside risks. ATM IVs are still stuck between 7-8% ranges for 3-6m tenors.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned to 51 (which is bullish) on UK’s CPI data prints which is line with consensus (actual 3.0% versus consensus and previous prints at 3.0%), while hourly USD spot index was creeping up at shy above -74 (bearish) while articulating (at 10:52 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bitcoin Reserves Hit 5-Year Low as $2.15B Exits Exchanges – Bulls Quietly Loading the Spring Below $100K

Bitcoin Reserves Hit 5-Year Low as $2.15B Exits Exchanges – Bulls Quietly Loading the Spring Below $100K  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Ethereum Ignites: Fusaka Upgrade Unleashes 9× Scalability as ETH Holds Strong Above $3,100 – Bull Run Reloaded

Ethereum Ignites: Fusaka Upgrade Unleashes 9× Scalability as ETH Holds Strong Above $3,100 – Bull Run Reloaded  EUR/USD Smashes 1.1660 as ADP Jobs Massacre Crushes the Dollar

EUR/USD Smashes 1.1660 as ADP Jobs Massacre Crushes the Dollar  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Europe Confronts Rising Competitive Pressure as China Accelerates Export-Led Growth

Europe Confronts Rising Competitive Pressure as China Accelerates Export-Led Growth  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data