Do you think GBPUSD is the worst behind us? Are Brexit negotiations better prospects?

Prime Minister May surprised the market by calling for a snap general election on 8 June.

Sterling has been the top performer in our sample this week, based entirely on the UK snap election announcement. The market bid sterling in the expectation that an enlargement of the Conservative majority in the UK parliament will facilitate a smoother negotiated Brexit.

Sterling was the top performer this week following Prime Minister May’s surprise announcement of a snap general election on June 8. The market immediately saw the election as positive for sterling, given the opinion polls showing a commanding lead by the ruling Conservative party.

An enlarged Conservative majority in the House of Commons was perceived as providing more flexibility to the government in the upcoming Brexit negotiations.

A renewed parliamentary 5-year term that ends well beyond the current two-year Article 50 timeline also boosted the confidence of a more positive outcome to the negotiations. Sterling held on to those election-inspired gains despite a rather poor UK retail sales report on Friday.

OTC FX outlook:

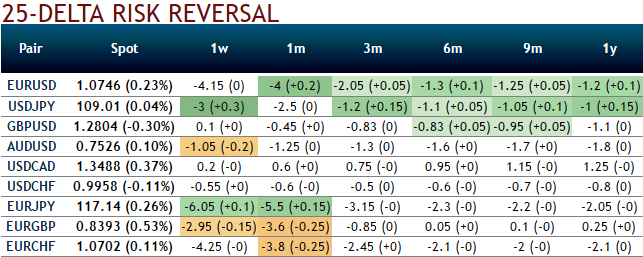

The options positions set to shift and the FX OTC market is seeing a wave of unwinding of medium-term bearish puts as the 1y GBPUSD risk reversal has softened to its lowest level since end- 2015. You could make out this from the short covering curves, positive flashes of risk reversals in 3-9m tenors and bearish-neutral numbers.

Risk reversals have led the spot positioning in the past, and the latter is still exhibiting extreme shorts.

Along with the shift in this hedging setting, shrinking implied volatilities in short tenors would imply that right times for exorbitant put option writers to snap the interim rallies to hedge the long-term bearish trend. A seller wants IV to fade away so the premium would also shrink away. You should also note short-dated options are less sensitive to IV, while long-dated is more sensitive.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch