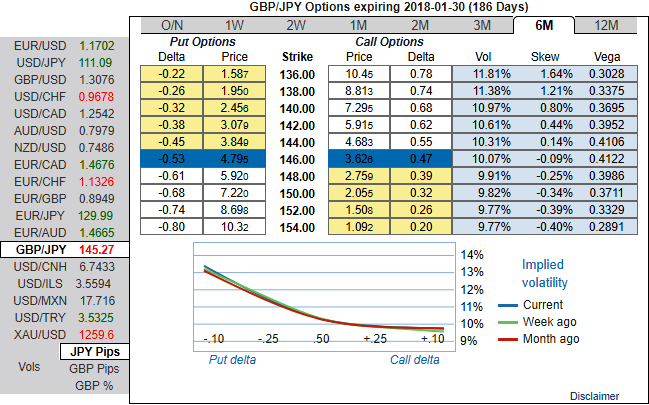

Before we begin with this write u, let’s just glance through GBP IV skews and delta risk reversals of GBP crosses.

Please be noted that the positively skewed IVs of GBPJPY of 6m tenors signify the hedgers’ interests in OTM put strikes and so is the case with GBPUSD. The IVs of these tenors are just shy above 10.14% and 8% for GBPUSD and GBPJPY respectively which is highest among G7 currency space, while higher IVs with positively skewed IVs signify the hedgers’ interest for both OTM put strikes which are as per the forecasts of JP Morgan.

While the nutshell showing risk reversals of GBP crosses have also been indicating bearish risks ahead.

The currency outlook for GBP crosses is still quite as uncertain as Sterling at present seems fragile on the list of mysteries has been dominated by politics over the past year -the overarching issue of Brexit of course followed by the indecisive general election which could yet alter the contours of Brexit and fiscal policy, as per JPM’s forecast.

Over the past month, however, the prosaic issue of monetary policy has come to dominate. The BoE surprised observers by signaling a less patient attitude to the continued rise in inflation even as the economy continues to slow (3% inflation, 1% growth).

Three of the eight MPC members voted to hike in June, up from two in May, and the Governor and the chief economist, both of whom voted for steady policy in June, subsequently articulated arguments for starting to remove monetary stimulus.

A hawkish pivot in monetary policy would normally be a straightforward positive for the currency, as has been the case in other countries.

In GBP's case, however, this assessment needs to be qualified because of:

1) A lack of clarity about the BoE’s reaction function, and

2) The conjuncture weakness in the economy which doesn’t necessarily support an early or extended hiking cycle. In other words, there is uncertainty about how the BoE will act and also how the currency will respond to this.

GBP remains positively correlated to interest rate differentials but there is evidence that the beta to rates is declining as investors wonder whether a hike is appropriate seeing that the economy is growing by only 1% or so (a 10bp shift in the UK-G10 rate differential is currently worth 0.4% for the GBP TWI). The bottom line is that anti-cyclical rate hikes motivated by inflation are rather more ambiguous for the exchange rate than hikes justified by a strong economy.

On this grounds, it is decided against upgrading our medium-term forecast for the GBP TWI even though our economists have brought forward the first BoE hike to August 18 (the curve is priced for May 18). To justify a materially bullish forecast for GBP we would need to see growth accelerating, not just inflation.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different