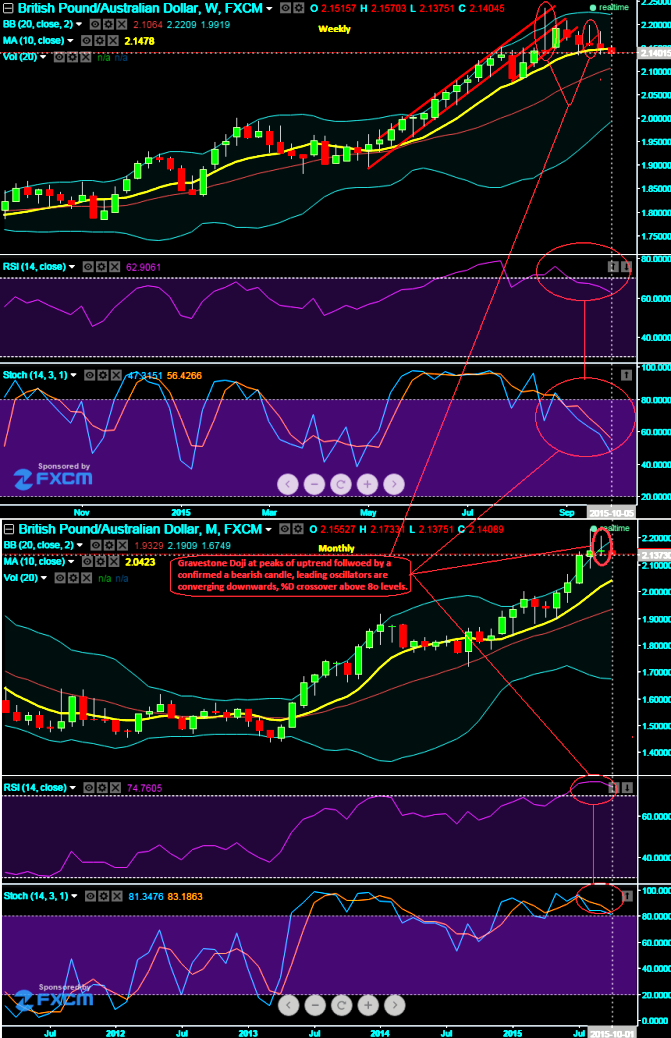

We traced out bearish gravestone doji patterns around 2.1552 levels on monthly charts as well as on weekly charts at around 2.1458 and again on 2.1586 levels. These bearish pattern dojis are an extremely helpful for traders visually to see where resistance and supply is likely located. After an uptrend, the Gravestone Doji can signal to traders that the uptrend could be over and that long positions should probably be exited.

But other indicators should be used in conjunction with the Gravestone Doji pattern to determine an actual sell signal. A potential trigger could be a break of the upward trendline support.

To substantiate this reversal stance, leading oscillators are also converging downwards with current falling price fluctuations. The daily current prices have shown their impact of this bearish candle pattern. The pair has fallen from the formation of 1st doji at 2.2370 up to 2.1373 levels.

RSI on weekly is currently trending near 63.4980, while %D crossover on slow stochastic still maintains around 60 levels that signify bearish momentum is continuing. Daily prices are well below moving average curve.

We maintain our bearish stance on this pair as the current spot prices have been well below moving average curve that signals us long term bearish trend is on the cards.

The pair has pretty much responded as per analysis and we could now foresee our target at 2.1185 levels towards south.

Trade recommendation: GBPAUD option strips strategy should take care of any abrupt upswings and certain downswings and yields handsome returns on the downside.

FxWirePro: Strong GBP/AUD bearish signal by gravestone doji and leading oscillators

Monday, October 5, 2015 11:47 AM UTC

Editor's Picks

- Market Data

Most Popular