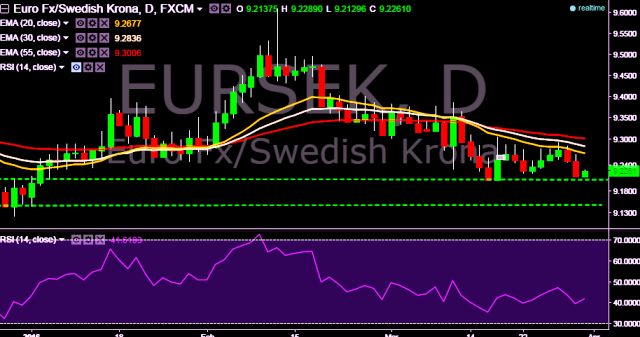

- EUR/SEK is currently trading around 9.2258 levels.

- It made intraday high at 9.2289 and low at 9.2129 levels.

- Pair fails to fall below key support at 9.2129 and supported above 9.2200 marks.

- Intraday bias remains bullish till the time pair holds key support at 9.2129 levels.

- A daily close below 9.2129 will drag the parity down towards key supports at 9.2050/9.1471 marks.

- Alternatively, current rebound from 9.2129 will likely to take the parity higher towards key resistances at 9.2718, 9.2774, 9.2871 and 9.3082 marks.

- Important to note here that 20D, 30D and 55D EMA heads down and signals bearish trend.

We prefer to take long position in EUR/SEK around 9.2180, stop loss 9.2050 and target 9.2718 marks.