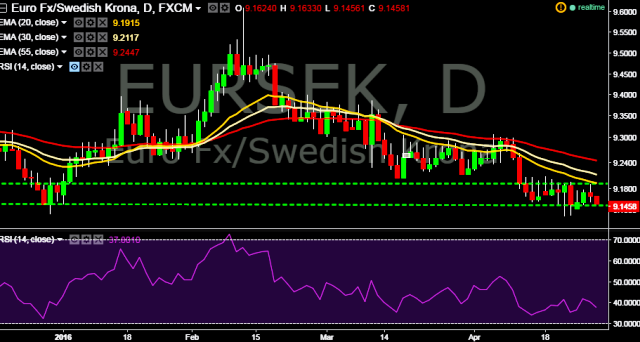

- EUR/SEK is currently trading around 9.152 levels.

- It made intraday high at 9.1633 and low at 9.1495 levels.

- Intraday bias remains bearish for the moment.

- A daily close below 9.1437 will tests key supports at 9.1273 and 9.0846 marks.

- Alternatively, reversal from key support test key resistances at 9.1743/ 9.1907/ 9.1880/ 9.2050 marks.

- Important to note here that 20D, 30D and 55D EMA heads down in daily chart and confirms the bearish trend.

- Today Sweden will release retail sales data at 0730 GMT. Market anticipates a rise of 0.5% m/m vs -0.2% m/m previous release.

We prefer to take short position in EUR/SEK at 9.1520, stop loss 9.1633 and target 9.1437/ 9.1273 marks.