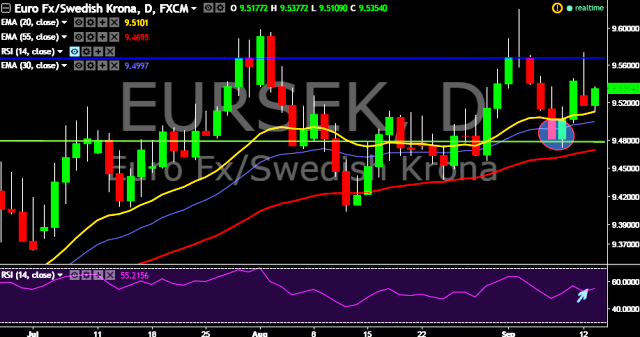

- EUR/SEK is currently trading around 9.5351 levels.

- It made intraday high at 9.5377 and low at 9.5109 levels.

- Intraday bias remains neutral for the movement.

- A daily close below 9.53 will take the parity down towards key supports at 9.5109, 9.4637, 9.4406, 9.4217, 9.4046, 9.3637, 9.3434, 9.3267, 9.2928, 9.2790 and 9.2582 marks respectively.

- On the other side, a daily close above 9.5467 is required to take the parity higher towards key resistances at 9.5675, 9.5713, 9.5993, 9.6109 and 9.6742 marks.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

- Sweden will release CPI data at 0730 GMT.

We prefer to go short on EUR/SEK around 9.54, stop loss at 9.5744 and target of 9.5109.