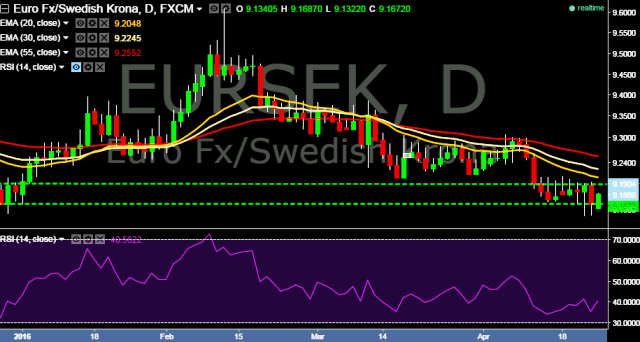

- EUR/SEK is currently trading around 9.1670 levels.

- It made intraday high at 9.1685 and low at 9.1322 levels.

- Intraday bias remains bullish for the moment.

- A daily close below 9.1492 will tests key supports at 9.1437 marks.

- Alternatively, current upward trend test key resistances at 9.1760/9.1880/9.2050 marks.

- Important to note here that 20D, 30D and 55D EMA heads down in daily chart and confirms the bearish trend. Current upward trend is short term correction only.

We prefer to take long position in EUR/SEK at 9.1625, stop loss 9.1510 and target 9.1760/9.1880 marks.