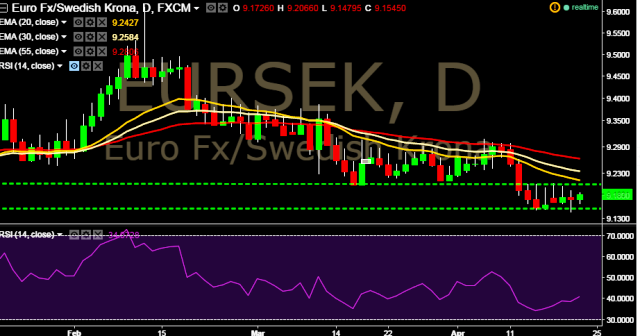

- EUR/SEK is currently trading around 9.1832 levels.

- It made intraday high at 9.1881 and low at 9.1613 levels.

- Intraday bias remains neutral for the moment.

- A daily close below 9.1613 will likely to take the parity down towards key support at 9.1492 marks.

- Alternatively, reversal from key support will take the parity up towards 9.2050/9.2630/9.3515 marks.

- Today Riksbank will announce Sweden’s interest rate decision at 0730 GMT. Market anticipates interest rate will remain stable at -0.5%.

- Important to note here that 20D, 30D and 55D EMA heads down in daily chart and confirms the bearish trend.

We prefer to take short position in EUR/SEK at 9.1850, stop loss 9.1905 and target 9.1492 marks.