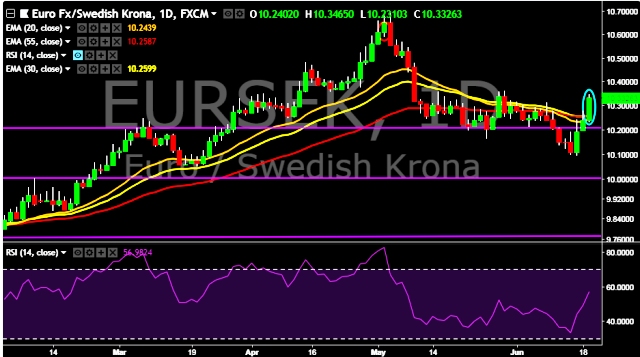

- EUR/SEK is currently trading around 10.3145 levels.

- It made intraday high at 10.3465 and low at 10.2310 levels.

- Intraday bias remains bullish till the time pair holds key support at 10.1961 mark.

- A daily close above 10.1912 is required to take the parity higher towards key resistances at 10.2343, 10.2464, 10.2773, 10.2993, 10.3465 and 10.3622 marks respectively.

- On the other side, a daily close below 10.1912 will take the parity down towards key supports at 10.1715, 10.1643, 10.1356 and 10.1125 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart. Current upside movement is short term trend correction only.

- Sweden May 2018 unemployment rate increase to 6.5 (forecast 6.5 ).

- Sweden May 2018 unemployment rate SA increase to 6.1 (forecast 6.3 ).

- Sweden May 2018 total employment increase to 5.101.

We prefer to take long position in EUR/SEK around 10.3150, stop loss 10.1912 and target 10.3622.