The prolonged antipodean bearish stance allure strategies through FX options on various fundamental driving forces.

The weakness in the kiwi dollar is predominantly owing to the amplified measures of inflation by the RBNZ was modest and shouldn’t warrant substantial changes from the central bank in the context of softer growth.

While for Australia, firmer employment data is being offset by higher supply as well, so will not impact wage growth by much leaving the immediate impact on the RBA muted at least for now.

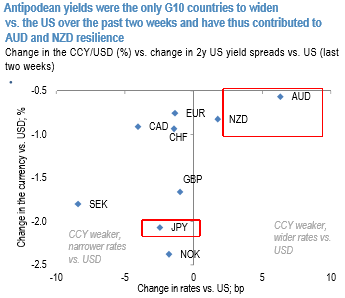

Moves in JPY over the past two weeks have also been unusual in that they are in excess of the moves in interest rate differentials (refer above chart) and came despite developments in China and escalating trade risks.

A few explanations have been discussed in relation to the underperformance of yen—it could be related to the resilience in equity markets thus far, or could be related to capital outflows: our Japan strategists note that this is likely a combination of larger FDI and portfolio investments outflows (for context, that M&A outflows have been higher in 2018 but this was concentrated in April due to a larger, single deal; the first half of July has seen a modest pickup after some cooling in May and June;).

The US dollar should be boosted further ahead of the Fed hikes further this year, and that will push NZDUSD lower. In addition, the NZ-US interest rate advantage has been eroded, removing one of the previous attractions of the NZD. Further, domestic data is indicating the NZ economy is slowing. We expect NZDUSD to slide to 0.67 or lower by Sep.

However, we continue to find value in being long JPY. Not only does this serve as a tail risk hedge, but our Japan strategists note that over the medium term, the synchronized rise in USDJPY and Nikkei index provides the BoJ with an opportunity to tweak its policy. If 10Y UST yield were to pick up from here, it would make it even easier for the BoJ to allow 10Y JGB yield to rise above 10bp to support the Japanese banking system.

The timing of this policy shift remains unclear, but an indication of a higher yield target would be JPY bullish in our view.

Moreover, our recommended trade has limited downside (we are long an AUDJPY put funded by AUDJPY call spread).

Buy EURNZD at 1.7248, stop at 1.7156.

Add longs in a 3m AUDJPY put, strike 77.50, short a 3m AUDJPY 81.25-83.50 call spread, spot reference: 82.250.

Short NZDUSD through a covered put. Take profits on short cash from 0.6893 for +0.88%, spot reference: 0.6795.

Stay short a 2m 0.6677 NZDUSD put. Courtesy: JPM, Westpac

Currency Strength Index: FxWirePro's hourly AUD spot index is at shy above 42 levels (which is bullish), while hourly NZD spot index is edging higher at 53 levels (bullish), USD is at 1 (neutral), JPY is at 45 (bullish) while articulating (at 14:07 GMT). For more details on the index, please refer below weblink:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge