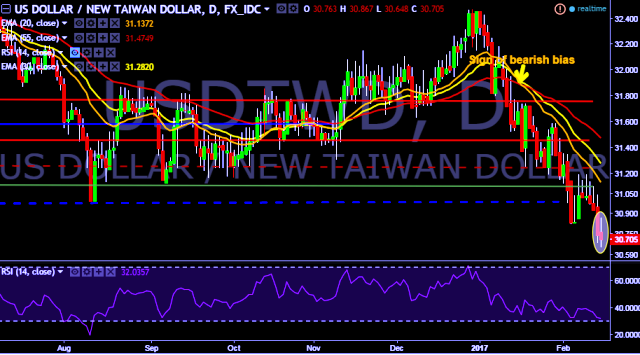

- USD/TWD is currently trading around 30.70 mark.

- It made intraday high at 30.86 and low at 30.64 marks.

- Intraday bias remains bearish till the time pair holds key resistance at 30.99 marks.

- A sustained close below 30.73 mark will test key supports at 30.48, 30.32 and 30.18 marks respectively.

- Alternatively, reversal from key support will drag the parity up towards key resistances around 30.99, 31.10, 31.25, 31.35, 31.44, 31.58, 31.72, 31.98, 32.12, 32.25, 32.43 and 32.63 marks respectively.

- Taiwan stocks open up 0.1 pct at 9,724.13 points.

We prefer to take short position in USD/TWD around 30.75, stop loss at 30.99 and target of 30.48.