Bullion price has taken a pause, as the bar for the Fed to ease again in the near-term is high. Gold’s (XAUUSD) price has reclaimed $1,450 mark in the recent past, but upside traction cannot be ruled as the major uptrend has shown upsurge almost about 61.8% Fibonacci levels from the 2015 lows of $1046 levels. We have listed quite a few bullish and bearish scenarios of gold’s price trend.

Bearish Scenarios:

1) The Fed sends materially more hawkish signals than what is currently expected/priced into the market;

2) The global economic growth momentum recovers much stronger than expected;

3) The geopolitical and political risks recede more than expected;

4) Central banks actually begin selling gold on net to take advantage of high prices.

Bullish Scenarios:

1) In response to deteriorating macro data, the Fed does not stay on hold and begins cutting rates again;

2) Inflation comes in hotter than expected but the Fed stays firmly on pause sending real rates lower;

3) the US dollar weakens dramatically as US exceptionalism fades

4) The global recessionary risks rise as indicators begin to signal a deterioration in consumption;

5) The US labor markets weaken significantly;

6) Asian physical buying sharply picks up.

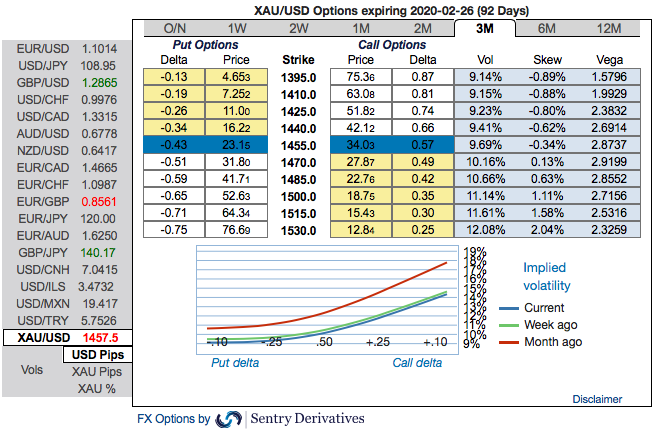

The 3m positive skewness of options contracts of gold implies more demand for calls than puts (refer 1st chart). These skewed IVs of 3m XAUUSD contracts are still indicating the upside risks. One could also see bullish risk reversal setup. To substantiate the above-mentioned dubious bullish sentiment, risk reversal (RRs) numbers indicate overall bullish environment amid minor negative hedging sentiments (2nd nutshell).

The above risk reversal numbers have been known as a gauge of gold’s underlying market for bullish opportunities. Well, we know that options are predominantly meant for hedging a probable risk event in future.

Trading and Hedging Strategy:

We rightly predicted the abrupt dips in the gold price in the short-run, capitalizing on that and OTC indications, bullish neutral risk reversals of gold, we advocated longs in gold via ITM call options as they look to be the best suitable at this juncture.

Thus, we still advocate buying 3m XAUUSD (1%) ITM -0.69 delta calls on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying. Courtesy: Sentrix and Saxobank

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand