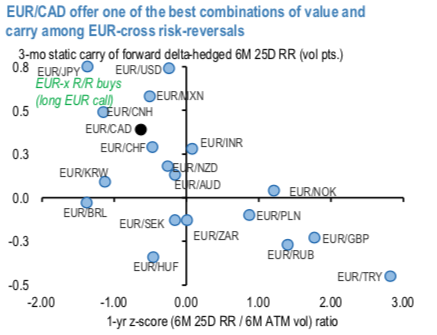

CAD option risk premia appear oblivious to the fallout of this high stakes standoff, perhaps because of the comatose state of currency markets at present. EURCAD risk-reversals, in particular, appear too complacently priced: at zero across the curve, they are well discounted to already low USDCAD risk-reversals (3M 0.35, 1Y 0.7), and underpriced relative to even tepid recent realized spot- vol correlations (SABR implied 6M spot-vol corr. in EURCAD r/r 1% vs. trailing 1m spot-vol corr 15%). Aside from the flatter term structure that helps to extend option tenors without incurring much roll cost, the principal advantage of EURCAD riskies over USDCAD is their substantial positive carry when bought in delta-hedged format.

Unsurprisingly, the source of this carry is elevated Euro forward points: close-to-zero risk-reversals incur very little time decay on a naked basis, while the forward delta- hedge (short EURCAD forward) earns substantially more interest rate carry. The net result is that delta-hedged EURCAD riskies are meaningfully positive carry instruments, in contrast to USDCAD riskies that incur both negative smile theta and negative points carry on the delta hedge on account of higher US rates than Canada’s.

Since high Euro points are the principal driver of this carry advantage in EUR-cross risk-reversals, the skew vs. forward carry disconnect exists to varying degrees across the entire EUR/high-beta FX universe and is not limited to EURCAD; the latter only stands out on valuation screens because of their eye-catching depressed skew levels (refer above chart). The chart displays that EURMXN riskies are also almost equally well-priced, and present an even bigger skew vs. forward point disconnect than EURCAD; they can be particularly useful overlays on Mexican bond longs that are well represented in most global bond portfolios. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly CAD spot index is flashing at 65 levels (which is bullish), while EUR is at -33 (mildly bearish), hourly USD spot index was at 83 (bullish) while articulating at (12:43 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge