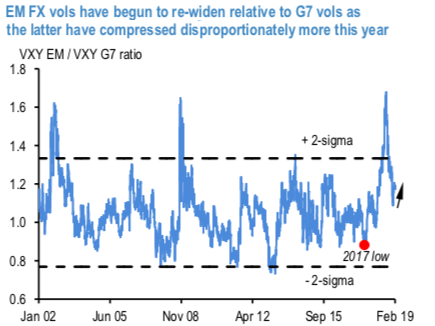

An odd by-product of the nosedive in G7 vol has emerged: EM vs. G7 vol spreads are re-widening, not because risk premia in EM are rising as was the case last year – quite the opposite in fact – but because G7 options have cheapened disproportionately more (refer 1st chart).

Rewards from outright vol selling are absolute, not relative quantities, yet this comparative EM – G7 vol set-up is motivating many to consider short EM FX vol plays as a complement to long carry portfolios. One cannot argue with a theme that is so manifestly working – 2nd chart displays that conventional high-beta EM names like TRY, MXN and KRW led the short vol league tables so far, with sizeable 1.5 – 3.0 % pt. P/Ls, in contrast to mild losses from selling AUD and NZD vol where central bank and data-driven spot gyrations were more acute.

We ourselves are running short TRY and MXN vol in our model portfolio in more cautious formats than outright straddles (TRY – ratio USD put/TRY call spreads; MXN – calendar risk-reversals).

TRY in particular offers above-average vol risk premium to monetize (1M ATM 13.0 vs. trailing 1m realized vol 8.0); we think implied vols are being kept artificially elevated by macro demand for directional carry- earning purchased option structures (USD puts/put spreads/digitals), but the historical track records of cash FX carry versus vol carry in the lira are so starkly divergent (refer 3rd chart) that we think levered money will be drawn to the latter sooner or later, which in turn should pressure vol lower. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 3 levels (which is absolutely neutral) while articulating (at 13:14 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data