Today’s euro area economic data flow kicked off with a couple of rare upside surprises, starting with the first estimate of French GDP in Q4. The figures showed an increase of 0.3%Q/Q, unchanged from Q3 and 0.1ppt above the market consensus and the rate of growth foreseen by the Bank of France. The interminably tedious EU-UK divorce continues.

Overall, we like to activate bearish EURUSD exposure and uphold shorts in EURCHF upon disappointing Euro area growth;

Account losses on medium-term option short in USDSEK, we argued that the big dollar turn was not yet imminent.

Nevertheless, the base case for 2019 did envisage a handover from the US to Euro area growth and mean-reversion in undervalued European FX like SEK. We had consequently added a medium-term put spread in USDSEK but structured it as a 1-1.5x to lower the cost as we lacked conviction that the trade was yet poised to work.

Euro area developments this week have been uniformly euro bearish with PMIs making near 5-year lows. The ECB changes its risk assessment on growth to the downside and the subsequently released German IFO survey also disappointed, with the expectations component signaling GDP growth of only 0.7% pace.

Given recent surveys, downside risks to Euro area growth and hence EURUSD remain and hence we recommend:

1) Taking losses on our medium-term USDSEK shorts and

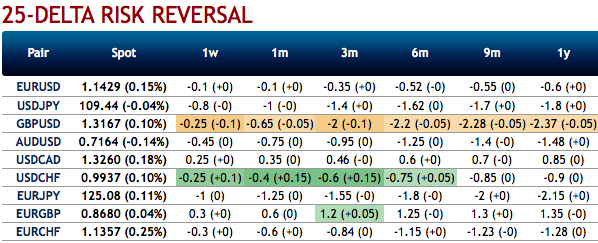

2) Please be noted that bearish neutral risk reversals of EURUSD that indicates the bearish risk in the major trend remains intact, which in turn appeals for activating outright short EURUSD exposure. EURUSD shorts are initiated through a 3m risk reversal to express the view that upside in EURUSD will be capped and also to benefit from risk reversals that are still near the upper end of their 6-month range. In addition, we maintain exposure to EURCHF on the expectation that soft growth will cap upside vs. CHF as well.

Buy 3m 1.1320 EURUSD put; sell 1.16 EURUSD call for net cost of 11bp. Spot ref: 1.14 levels, while simultaneously maintain shorts in EURCHF at 1.1244 with a stop at 1.1469. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 67 levels (which is bullish), while hourly USD spot index was at -44 (bearish) and CHF is -93 (bearish) while articulating (at 10:31 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.