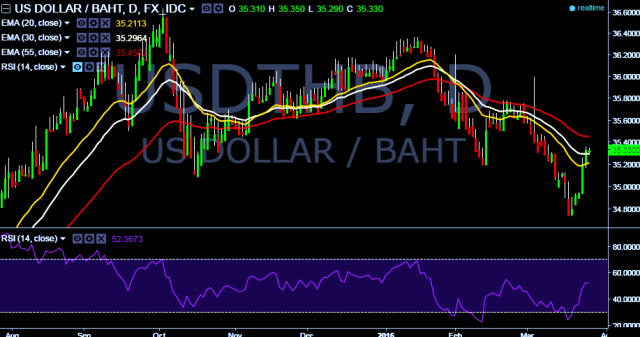

- USD/THB is trading around 35.33 levels.

- It made intraday high at 35.35 and low at 35.29 levels.

- Today Thailand released trade balance data with positive numbers at USD4.990B m/m vs USD0.240B m/m previous release.

- Custom based exports rises to 10.27% vs -8.91% previous release.

- In addition, custom based imports falls to -16.82% vs -12.37% previous release.

- Intraday bias remains bearish till the time pair holds key resistance at 35.42 marks.

- On the other side, a sustained break above 35.42 will drag the parity up towards key resistance at 35.54/ 35.73 levels.

- A break below key support at 34.74 tests 34.41 and 34.18 respectively.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.