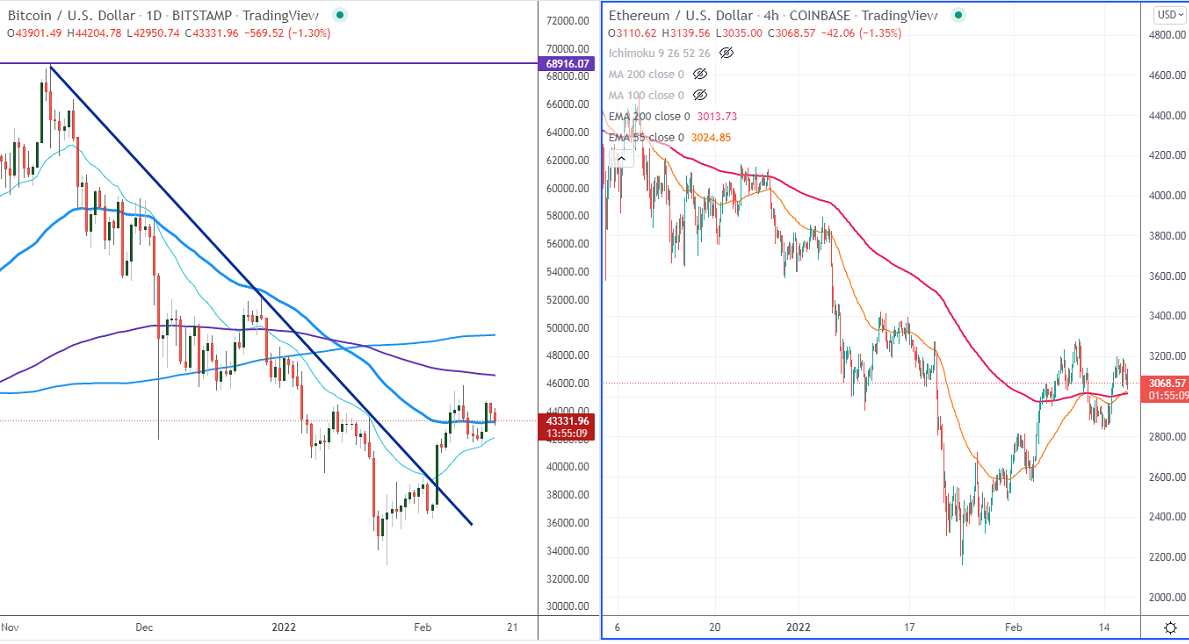

Bitcoin (BTCUSD)-

BTCUSD dropped more than $1000 after hitting a high of $44785 yesterday as demand for riskier assets reduced. Markets remain highly volatile on news that Ukraine fired mortar shells and grenades at four LPR locations. The pair hit an intraday low of $42950 and is currently trading around $43272.

Bear case-

Levels to watch- $41950 (200-4H EMA). Any convincing break below will drag the Bitcoin to the next level of $40220/$38000/$36250/$30000. Significant demand zones are $28000. A breach below that level will pull the BTC to $24900.

Bull case-

Primary supply zone -$46000. The breach above confirms minor bullishness. A jump to the next level $49260 (200-day MA)/$50000/$52200. Minor resistances are $43200/$45000.

Secondary barrier- $55000 (61.8% Fib). Any violation above that barrier targets $60000/$69000 (an all-time high).

CCI (50) above and Woodies CCI below zero line in the 4-hour chart.

It is good to buy on dips around $42800-$43000 with SL around $40000 for TP of $53000.

Ethereum (ETHUSD)-

ETHUSD is consolidating between $3284 and $2836 for the past week. It hits a low of $3035 at the time of writing and is currently trading around $3056.

Bear case-

Levels to watch- $2800. Any close below will drag the ETH to near-term support of $2590/$2400/$2150. Major demand zones are $1700. A breach below $1700 targets $1500/$1288.

Bull case-

Primary - Barrier- $3350 (200- day EMA). The jump above will mark the beginning of an intraday bullish trend. Surge past will push the prices higher till $3585 (200-day MA)/$3670/$3800/$4000.

Secondary barrier- $4000. Breach that barrier targets $4150/$4500/$4784.

It is good to buy on dips around $3000 with SL around $2800 for TP of $4300.