Full-scale U.S.-Japan trade negotiations could affect JPY fairly substantially. We point out five key factors below, the first three of which could lead to JPY appreciation in the short term and the last two of which could lead to JPY depreciation in the medium term.

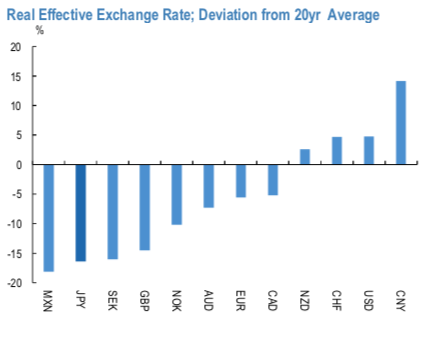

1) President Trump's criticism of JPY weakness: If President Trump mentions the extent to which JPY is undervalued and tries to put upward pressure on JPY, JPY could strengthen a fair bit in the short term. It can be argued that JPY is considerably more undervalued than EUR or CNY, as its real trade-weighted value is 16% below its 20- year average (refer 1stchart).

2) Battles over a currency clause: It remains to be seen whether a U.S.-Japan trade agreement includes a currency clause. Japan has maintained its insistence on discussing exchange rate policies separately from trade issues and is opposed to the inclusion of any currency clause in a trade agreement.

3) Quotas and tariffs on auto imports: Auto tariffs are not limited to negotiations with Japan, but trade surplus in autos accounted for ¥4.4 trillion of Japan's ¥6.5 trillion trade surplus with the United States in 2018 (refer 2ndchart). If the U.S. government starts to seriously consider charging tariffs on auto imports, this will become a serious risk to the Japanese economy. Even such concerns could put upward pressure on JPY.

4) How much Japan compromises and increases imports from the U.S.: Japan recorded ¥6.5 trillion of trade surplus with the U.S. in the last year. To reduce the trade imbalance with the United States substantially, Japan may need to import much more from the United States, by lowering tariffs on agricultural products and buying more defense equipment. Japan’s total trade balance may record a persistent deficit in the future if its imports from the United States increase in increments of several trillion yen over the longer term. A swing to a trade deficit will become an important negative factor for JPY in the long term.

5) The possibility that the U.S.–Japan Security Treaty will be used as a negotiation tool: President Trump said he thinks the agreement is an unfair one. It is unlikely that the United States will pull out of the mutual security agreement, but the Trump administration could still very well use the threat of changes to the treaty as a tool in the trade talks. In this case, Japan would be in a weak position and may have to agree to additional concessions.

Japanese investors will be happy to buy on dips to increase overseas investment. Therefore, we don't expect sharp JPY appreciation. Separately, the BoJ will hold the monetary policy meeting on July 29-30th. We don’t expect BoJ to move in this meeting, but we expect the bank will cut policy rate to -0.3% from -0.1% in September 18-19 meeting. On the flip side, the Fed is scheduled for their monetary policy on 31st July, wherein, 25 bps cut is the common consensus.

Contemplating all the above factors, shorting USDJPY futures contracts of mid-month tenors have been advocated, on hedging grounds ahead of BoJ and Fed’s monetary policies that are scheduled on 29thand 31st July, we now like to uphold the same positions as the underlying spot FX likely to target southwards below 106 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: JPM

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts