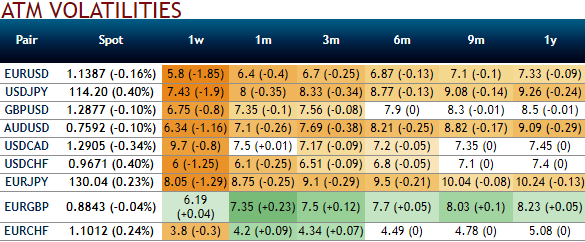

Please be noted that the implied volatilities of GBPUSD ATM contracts from the nutshell evidencing ATM IVs of all expiries have been shrinking below 7.5%, in addition to that the underlying spot FX has been in range bounded trend and it has been foreseen to persist further in near future. If you have the short leg in your options strategy, it is quite good to expect vols shrinkage. An option writer wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated is more sensitive.

Amid low vols regime, we had already recommended below option strategies using right options in mid-May, by now one could have benefited from certain returns from this short legs. We still want to uphold the strategy on speculative grounds.

Naked Strangle Shorting:

Short 1m OTM put (1.5% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (we reiterate, preferably short term for maturity is desired).

Overview: Slightly bearish in short term but sideways in the medium term.

Time frame: 1-month tenor

Alternatively, one can also prefer iron condor on the same lower IV circumstances. To execute the strategy, the options trader buys a lower strike OTM put, sells a middle strike ATM put, sells a middle strike at-the-money call and buys another higher strike OTM call. This results in a net credit to put on the trade.

For all of the intense focus on the Brexit process, GBP’s fate over the coming 12 months may ultimately be determined by more parochial, and in all likelihood negative, cyclical factors.

How does theta function:

For an instance, as we know theta measures time decay in the options premium value per day which means as shown in the diagram the premiums on short leg today is worth $763.85 and theta is $29.25 then over every time break, all else been equal, the option premium should be waning out to $734.60. This would be the case even when underlying spot never goes up but remains in sideways.

Option sellers can reap the benefits of a high Theta near expiry by selling short-dated ATM options with the expectation of little to almost no market movement.

For ITM and OTM options as the time to expiry draws nearer, Theta lowers and decreases.

Well, in above case, the strategy could be constructed at the net credit, the short leg would be absolutely at profits when underlying spot remains either at strikes chosen.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts