Glimpse on Technicals: The pair has been bouncing from last 3-4 days after testing supports at 121.680. Upswings favoured by momentum that signalled by leading oscillators, but longs accepted only above resistance at 123.1134 (7DMA) as major trend which is bearish is still remains intact. So short term bulls have to wait until it breaches resistance at 123.1134 levels.

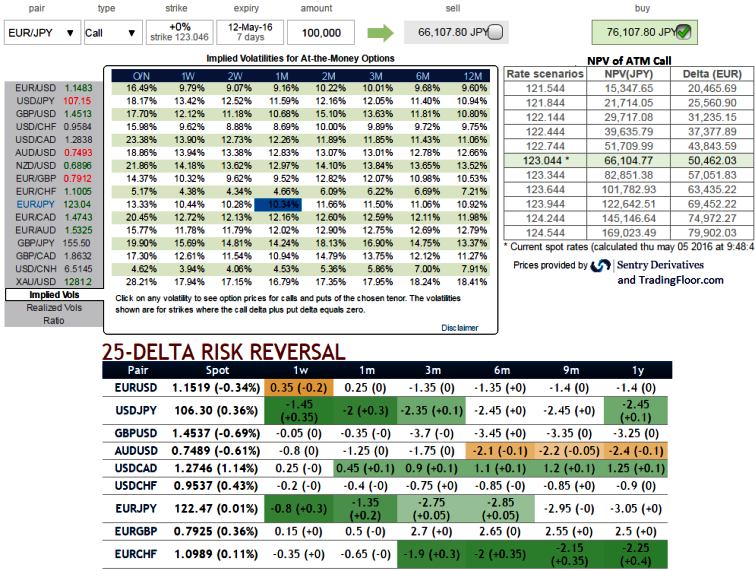

OTC Updates: The implied volatility of ATM contracts is at 10.44% for 1w expiries and for one month expiries is at around 10.34% which is reducing in long run as well.

As you can see ATM calls are priced in 15% more than Net Present Value for 1W expiries, whereas IVs just above 10% and it is likely to reduce, hence, it is deemed as disparity between pricing and OTC market sentiments.

A seller always would need IV to fade away so the premium falls. Please also be noted that the short-tenor options are less sensitive to IV, while long-dated are more sensitive.

As the delta risk reversals are flashing up, but the long term negative numbers signify hedging sentiments are well equipped for downside risks over the period of time.

While current IVs of ATM contracts are at higher levels but likely to perceive on an average of 10.75% in long run would divulge pair’s weakness coupled with risk reversals.

Hence, considering Euro's implied volatility and OTC market sentiments we think more downside risks are still on the cards in long run amid minor upswings.

Inference & Remarks: Contemplating above technical indications and OTC reasoning, option writing on OTM instruments (ITM shorts) in short term would optimise any hedging strategy.

As result of deploying ATM delta instruments would be the answer for both speculation and hedging if you think speculation in potential uptrend in short terms is not possible as delta risk reversal suggested puts have been overpriced then use OTM puts that are available in cheaper premiums comparatively.

But don't you dare to buck the trend and miss long opportunities in prevailing bear trend.