Technical roundup:

Lot of puzzling has been happening in CADCHF when we consider the intermediate trend of this pair, as per our previous post on technicals, the prices are going in sideways, and now it is time for CHF back again that all chances of recoveries, the major trend moving in sideways (see price actions in rectangular area), despite hammer pattern formation on monthly graph it don't seem to evidence upswings. However, a decisive breach above 7EMA (on monthly) can be deemed as the change in direction of the trend, so we advise to trade this pair with below option strategy recommendations.

OTC Updates and Option Strategy:

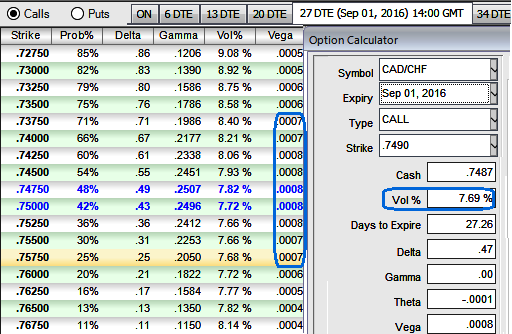

Currently the pair is trading at 0.7470 with the volatility of ATM contracts marginally creeping up (at 7.69%), we do not expect any dramatic price moves on either side but this should not create any harm for our currency portfolio nor do we want to miss the opportunity in even though underlying spot drifting in sideways. We believe CAD’s gain is majorly depends on crude’s strength which seems unlikely at this juncture.

While the sensitivity tool signals vega on both ITM and OTM strikes has been stable, so this is one more substantiation for no much sensitivity to the option prices in this tenor.

Whereas, the long-term path for Swiss franc would be determined by who sees inflation first: The SNB’s inflation forecasts extend out to Q3 2018, but extrapolating the last year of forecasts, it would take until Q3 2019 to reach the 2% target. Hence, the CADCHF in any near or medium term evidences dramatic swings on either side.

Hence, the recommendation would be on buying OTM -0.49 delta put while simultaneously shorting ATM put with similar expiries and buy OTM 0.5 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as CADCHF is perceived to have a low volatility.

The highest return for this strategy is achievable when the pair at expiration is equal to the strike price at which the call and put options are sold. At this price, all the options expire worthless and the options trader gets to keep the entire net credit received when entering the trade as profit.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate