The trading call was generated with the help long bullish engulfing like pattern, positively converging leading oscillators and relevant volume confirmation. The bullish candle has broken crucial resistance at 91.311 levels, 14 day RSI at that point was positively converging along with healthy volume confirmation.

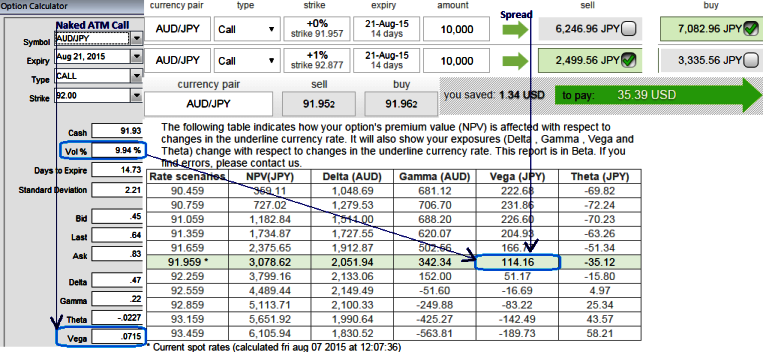

As you can see volatility of near month ATM calls are perceived almost close to 10% which is at quite higher side while vega of the same is at 715, using vega spreads we can neutralize and participate in prevailing short term uptrend.

AUD/JPY Put Ratio Back Spread:

One can build AUDJPY put ratio back spread regardless of swings by improving odds in its positions as explained below. That In-The-Money puts on short side in put ratio back-spreads are always at risk of exercise if the market tumbles, but you have two advantages.

Firstly, keeping maximum tenor on long side: Giving a longer time to expiration for long sides, any abrupt drastic moves on the downside so that assignment can be covered by the long puts.

Secondly, time decay advantage: Using near month contracts or contracts shorter tenor on short side signifies the importance of entering the position when IV is lower than average but AUDJPY IV is seen at 10% which is quite higher side (due to data season), so let us keep maturity on short side as normal as near month contract period. Time decay and implied volatility work in your favor on the short puts.

FxWirePro: Trade AUD/JPY with call spreads, hedge with PRBS

Friday, August 7, 2015 6:51 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate