The news flow from Beijing and Washington suggests that an agreement between the US and China is getting closer. Or rather: it does not look as if there is going to be renewed escalation, which the market is going to find even more important. That alone brings some peace and quiet. That becomes particularly obvious in the EURUSD exchange rate. The cross’s implied volatility has now fallen below the lows seen in 2014. It can't get more dead than that.

As long as the US and China continue negotiating, trying to work towards a deal, the calm is likely to continue, although we can easily imagine the market being back on alert very quickly once an agreement has actually been signed, as the negotiations are likely to resume immediately and it remains completely unclear for now how far US President Trump will want to go with the trade war during the election campaign. Until then the downward tendency in volatility is likely to remain in place though.

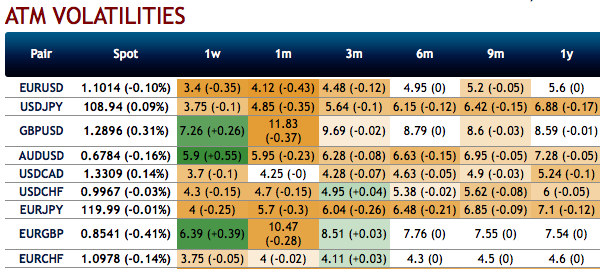

3M EURUSD IVs would hardly be stuck around the 4-5% mark. If one ignores GBP volatility though the FX market has returned to the vol lows seen last summer. The hopes are lingering that the vol levels seen at the time would be short-lived was correct in the sense that volatilities rose significantly in August.

However, there is no sustainable escape from the structural low volatility environment - that much has become clear. That is seemingly positive for all those for whom FX is an undesirable risk.

However, things become dangerous if the exchange rates no longer reflect fundamental data in a sufficient manner. Is that possible on the FX market considering the breath-taking turnover? If market participants consider low liquidity to constitute one of the biggest risks (as polls among market participants suggest) then we do have to worry about that.

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

Contemplating low IV environment, on trading grounds, we recommend executing butterfly spread.

So, buy 1m EURUSD OTM -0.49 delta put while simultaneously shorting ATM put of similar expiries and 1m buy OTM 0.51 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as EURUSD is perceived to have a low volatility. Courtesy: Commerzbank & Sentry

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty