Yesterday’s US inflation data disappointed. Both the overall rate and the core rate came in below analysts’ expectations. Is inflation pressure not going to materialize? As a result, shall we not see rapid USD-positive rate hikes? Let’s not get too excited.

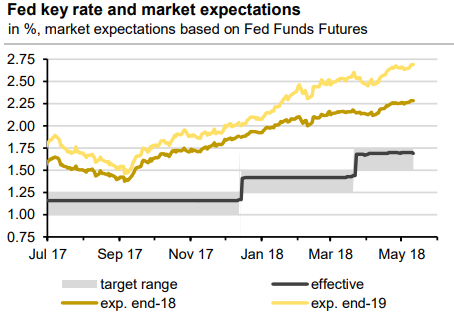

a) The Fed expectations did not suffer as a result of yesterday’s data (refer 1st chart).

b) If one carefully smooths the (seasonally adjusted) inflation data one can see that the (core) inflation trend remains very close to the 2% target (2nd chart).

The Fed does not provide for an overshooting of inflation – with the exception of individual FOMC members.

Contemplating these factors, we explore the factors driving the decline in Treasury holdings at large commercial banks. Rising recession tail risk motivates hedging against a sharp rise in term premium and advocate below interest rate trading strategy.

Use OTM 3s/10s/30s flies to monetize richer term premium in a rally.

Though the base case remains for above-trend growth and firming inflation, rising recession risks highlight the tails to a sharp shift in the outlook.

Weighted butterflies are a good replication of term premium, which tends to richen as the Fed cuts rates. Sell OTM 1Yx10Y receiver swaptions versus a weighted amount of 1Yx3Y and 1Yx30Y.

Sell $100mn notional of a 1Yx10Y 22-delta receiver (notification 4/29/19, maturity 5/1/29, strike @ 2.537%, premium 69.6c) versus buying $172mn notional of a 1Yx3Y 25-delta receiver (notification 4/29/19, maturity 5/1/22, strike @ 2.620%, premium 28.0c) and $12.4mn notional of a 1Yx30Y 25-delta receiver (notification 4/29/19, maturity 5/1/49, strike @ 2.582%,premium 175c). This trade is constructed to be premium neutral at inception. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -76 levels (which is bearish) while articulating (at 12:00 GMT).

For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data