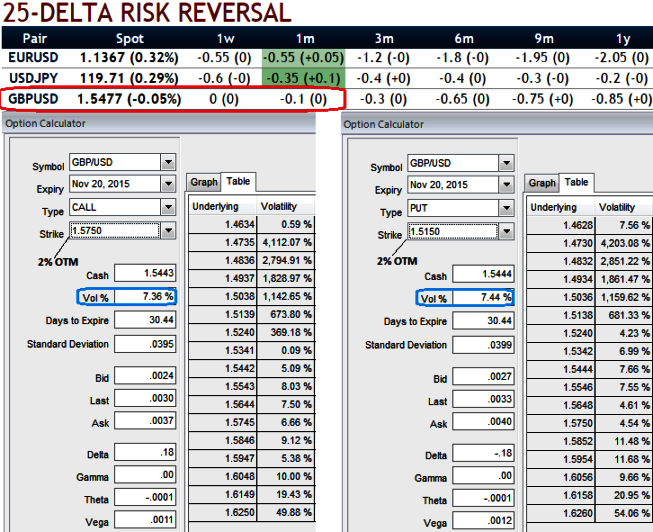

The cable's implied volatility of ATM is still perceived to be the least within next 1w-1m time frame in major G7 space (at around 6-7%), you can observe implied volatilities from the diagram:

While GBPUSD Spot FX is at 1.5440,

2% OTM put (strike at 1.5748) = 7.36%

2% OTM call (strike at 1.5131) = 7.44%,

Thus the difference is 0.08, the risk reversals of ATM contracts of 1 month maturities have no significant disparities between at the money and out of the money instruments (compare delta risk reversal with above computation of OTM instruments).

The pair is likely to evidence bearish swings, while plotting both daily and intraday charts we come across leading oscillators (RSI and stochastic) indicate downward convergence with price slumps.

While the current spot FX is sliding below lagging indicator (10DMA) on four hourly charts that signifies these price dips to prevail for some more time.

Hence, pondering over the range bounded trend but slightly downswings, FX OTC market sentiments for this pair we recommend shorting near month futures with a stop loss at 1.5456 for target at 1.5415, thereby observed risk reward ratio at 0.64.

FxWirePro: Trend analysis of GBP/USD using risk reversals, IVs and technical indicators

Wednesday, October 21, 2015 2:30 PM UTC

Editor's Picks

- Market Data

Most Popular