The trading week is off to a very quiet start with little by way of major market moves or calendar-based developments to consider. Ahead, the DXY may remain inherently top-heavy with downside support seen at the 200-day MA (95.333). Structurally, markets may continue to attempt to strike a balance between the weakened state of the USD and the still soggy global macro complex (which typically incites flight to the USD).

The one pushback against selling GBP vs JPY correlation at current market is value, or rather the lack thereof. Implied corrs have already subsided 15% pts. from their local December peak to near 2-yr lows and carry only thin premium over trailing realized corrs.

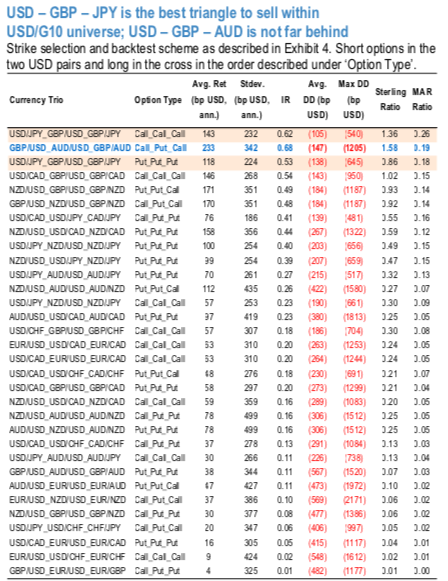

Within the GBP-cross universe, somewhat better value resides in GBPAUD options where nominal implied corrs. are 15-20 pts. higher, and which also incidentally ranks second next only to GBP/JPY on long horizon risk-return metrics from corr. selling in above chart (highlighted in blue).

Unlike GBPJPY however, GBPAUD is not asymmetrically profitable triangle play in calls and puts: Exhibit 5 suggests that owning GBP calls/AUD puts (against selling GBPUSD calls and AUDUSD puts) significantly outperforms owning GBP puts/AUD calls, presumably on account of GBPAUD’s traditional anti-risk sensitivity on the upside (i.e. spot tends to rally sharply in crashes).

Fortunately, this directional preference suits current tactically bullish GBP views to a tee, hence GBP call/AUD put spreads financed with AUD put/USD call spreads is a viable alternative to our GBPJPY – USDJPY call spread switch for expressing a constructive view on Brexit negotiation outcomes. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -21 level (which is mildly bearish), while hourly USD spot index was at 46 (bullish) while articulating (at 08:44 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis