We do not believe TRY will trade back below 2.85 going forward in long run despite some momentary dips.

Inflation differentials alone would take fair value to well above 3.00. Moreover the ongoing support from the EU on the refugee crisis may wane given Erdogan’s support for groups fighting Kurds across the border.

While, Turkey's new prime minister Binali Yildirim officially confirmed yesterday what many observers, we included, have always thought.

Mr. Yildirim kept his remarks, which were reported widely by the local media yesterday, nonspecific on timeframes, so as to leave some room for optimistic interpretations.

AKP currently has 317 seats in parliament (330 would be required even to launch a referendum). It is difficult to see opposition parties supporting this particular step towards a presidential system. This means that the likelihood of fresh elections within this year is very high.

Turkey’s nonfinancial corporate debt increased from 22% to 56% of GDP since 2007. This is the highest ratio for the higher yielding EM markets. In other words, as local interest rates are quite high, most of the financing has taken place in USD.

Meanwhile the CBT has barely accumulated FX reserves. The good news is that public debt ratios have improved in the last decade.

This may mean sovereign help if and once the private sector runs into trouble. We therefore expect USD/TRY to hit at about 3.10 by end H2 2016.

USD/TRY was up 0.23% to 2.9502, while EUR/TRY fell 0.09% to 3.2913 while articulating.

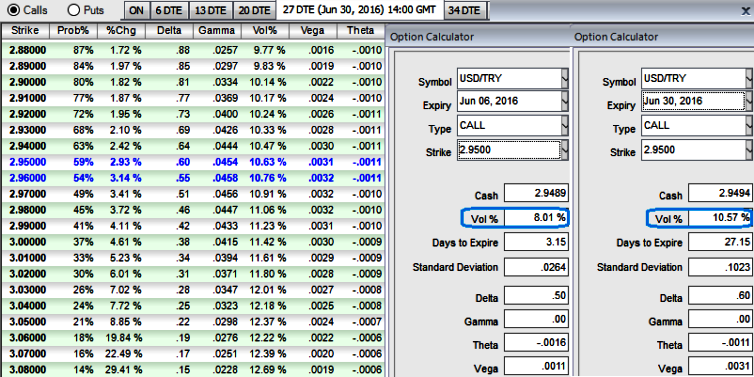

Thus, initiate longs in 3M ATM 0.50 delta call option while shorting 1M (1.5%) out of the money put with positive theta or closer to zero for time decay advantage on shorter tenors on short side.

Please observe the payoff table, as USDTRY creeps up at spot ref: 2.9502 the strategy constructed above is likely to fetch positive cashflows on expiry (%change), OTM call strikes have healthy vega with higher vols.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings