The estimates of UK GDP growth for Q4 has been projected to be a relatively modest 0.5%. That would be beyond the 0.4% rate recorded in Q3 but it would still only represent 'trend' growth. Indicators released so far for the quarter show no growth in industrial production and a fall in construction output, pointing to the service sector as still the only real driver of growth.

The key driver has been the stronger employment gains in Q4 that advocates that economic growth may be currently underestimated and other activity indicators for construction indicate that the official data for that area is particularly ripe for upward revision. However, as it currently stands, this growth figure will not put pressure on the BoE to consider an early interest rate hike.

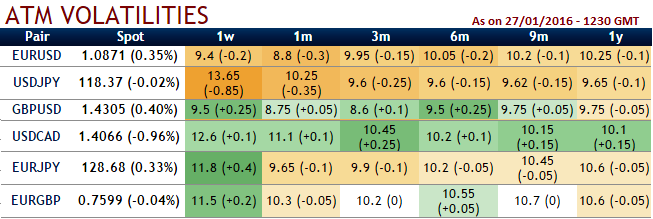

As anticipated, BoE's official bank rate has been unchanged at 0.5% for more than six years. It is far longer, and in near future GBPUSD may likely to experience low volatility as shown in the above nutshell. You can make out from the nutshell showing IV; GBPUSD is to have the least IV among G7 currency pool.

The trader can implement the below strategy using put options now with similar maturities to deal with lower implied volatility. Construct a butterfly spreads using puts as delta risk reversal has shifted market sentiments towards slightly downwards. One should use this when expectation the exchange price of the GBPUSD to change very little or within a very tight trading range over the life of the option contracts.

Since the cable's implied volatility is still perceived to be the least within next one-month time frame from other major G7 pairs (at around 8.5-9%), so here comes a multiple leg of option strategy for regular traders of this currency cross when there is little IV. A total of 4 legs are involved in the butterfly spreads strategy and a net debit is required to establish the position.

So strategy goes this way, writing 2 lots of at the money puts with positive theta and delta close to zero and buying (1%) out the money -0.26 delta put and buying another (1%) in the money -0.74 delta put for a net debit. In live scenarios use the longer maturities on longs and shorter maturities on shorts.

The highest return for this strategy is attained when the GBPUSD price remains unchanged or nearby ATM strikes at expiration. At this price, only the highest striking put expires in the money. On the flip side, maximum loss would be limited to the extent of initial debit paid to enter the trade plus brokerages.

FxWirePro: UK GDP data keeps GBP on check - deploy GBP/USD butterfly spreads as IVs likely remain the least among G7 FX space

Thursday, January 28, 2016 9:06 AM UTC

Editor's Picks

- Market Data

Most Popular