The pound was up against the dollar considerably in 2017 but its performance has been relatively weak in 2018. Since its peak in January, the pound has declined by almost 1000 pips. The pound is currently trading at 1.339 against the USD.

In recent weeks, the dovish rhetoric from the Bank of England (BoE), continued tensions between the European Union and the UK over Brexit trade agreement, and weaker than expected economic dockets have pushed the pound lower against the dollar. Along with inflation, the numbers from UK real estate sector, as well as manufacturing have been pretty weak.

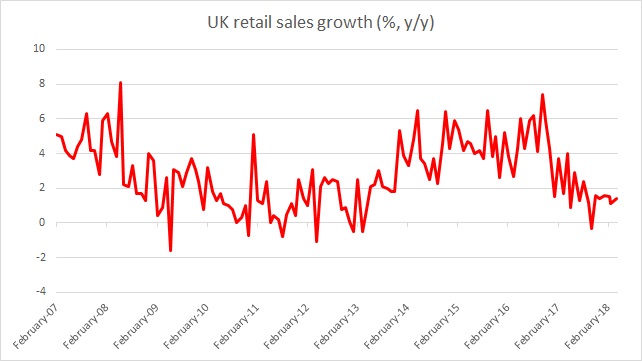

The focus for today is on UK retail sales, which has also been weaker in recent month. The report will be released at 8:30 GMT.

February retail sales preview:

- As said, this report would be vital in supporting the sterling. If the sales remain strong it would be an indication that people are willing to spend money, despite the uncertainties surrounding Brexit. It might be an indication that the people understand that Brexit would be a long process, hence that shouldn’t affect their purchases immediately but higher inflation likely to add to the cost.

- There is a saying that, when Britons are happy, they shop, but when they are sad, upset or tense they shop more. Retail sales figures, released since the Brexit referendum support this saying. However, it has shown weakness in 2018.

- After the crisis of 2008/09, the retail sales started to recover and the growth rate reached a level much higher than it was before the crisis. In August 2016, retail sales growth reached 6.6 percent. Compared to that, September was weaker with 4.1 percent y/y growth. In October, retail sales hit the highest level of growth for the year 2016 to 7.4 percent.

- However, growth has weakened since. See chart

Expectations today:

- UK retail sales are expected to grow by 2.4 percent y/y in May and by 0.5 percent on a monthly basis.

A weaker than expected report would lead to a further selloff in the pound. However, the current short-term bias remains to the upside thanks to dollar’s weakness.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX