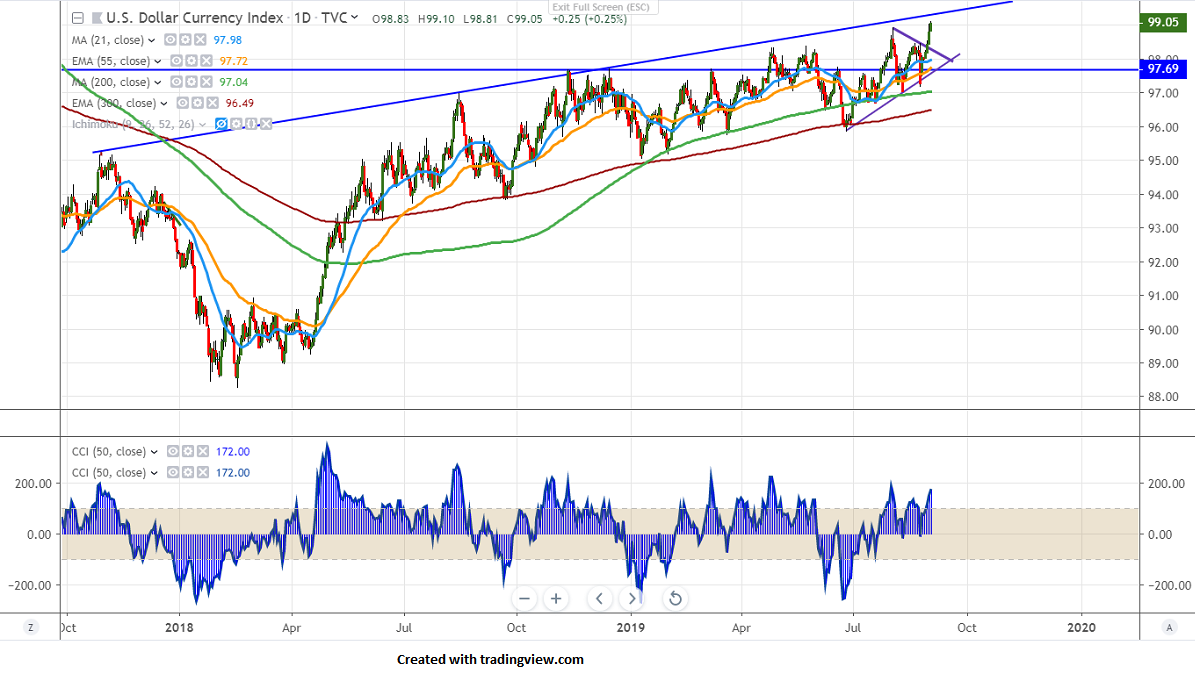

Major resistance- 99.25

US dollar index has broken major resistance 98.93 high made on Aug 1st and is on the upside for the past 6 trading days. The jump was due to broad-based US dollar buying and escalation of the US-China trade war. According to CME, the probability of 25 bps rate cut has increased to 96.9% from 94.6% and 50 bps cut to 3.1% from .4%. It hits an intraday high of 99.10 and is currently trading around 99.06.

Short- term trend is bullish as long as support 97.67 holds. The index is trading above 98.93 and it should break above 99.25 (trend line resistance). The decline from 103.65 will stop at 88.25 only if the index closes above 99.25 and a jump till 100% projection 100.25 likely.

The near term support is around 98.60 and any break below will drag the index down till 98.20/98/97.70. Any daily close below 97 confirms bearish continuation.

It is good to buy on dips around 98.55-60with SL around 98.20 for the TP of 100.25.