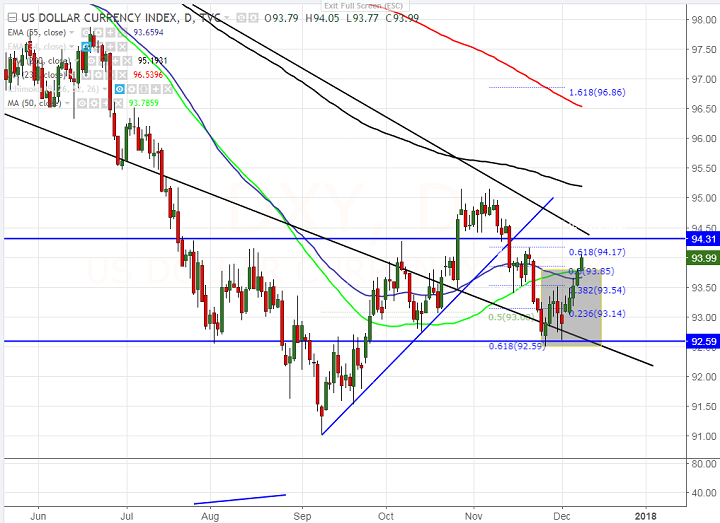

- Major resistance – 94.20 (61.8% retracement of 95.15 and 92.50).

- DXY has broken resistance at 93.75 and jumped till 94.05 at the time of writing. It is currently trading around 94.01

- The index is trading slightly above 50- day MA and any break above 94.20 (61.8% fibo) confirms further upside till 95/95.25 (200- day EMA). Short term bearish invalidation only above 95.25.

- On the lower side, any break below 93 confirms minor weakness. The index should close below 92.59 (61.8% fibo) for further decline till 91.62/91 likely. The near term support is around 93.40.

It is good to buy on dips around 93.65-70 with SL around 93.40 for the TP of 94.20/95.