Natural gas is currently trading at $3.2 per MMBtu.

Key factors at play in natural gas market –

- Gas price has moved higher as the inventories are declined fast due to the polar vortex and the market is currently pricing that the storage is likely to drop to 1.24 trillion cubic feet by the end of the winter.

- However, as the contract shifted it is declining sharply as the end of winter nears.

- China is suffering a shortage of gas supply, which is likely to influence price over the course of next year and next.

- Japanese importers are reportedly diversifying sources. Japan is in focus of producers as many long-term contracts are set to expire by the end of the decade. Japan is set to begin importing US LNG this year. Japan’s Kansai energy will import 1.2 million tons of US LNG for next 20 years. Japanese plants are already enjoying a buyer’s market and renegotiation is helping them to resale natural gas.

- Russia and the United States are set to fight for market share in Asia and in Europe. US preparing to become major natural gas exporter to the EU and Asia.

- Lithuania imported first-ever LNG cargo from the United States.

- Australia looking to beat Qatar to become world’s largest Gas supplier.

- EIA reports that the US is set to become a net exporter of natural gas in 2017.

- Large Natural gas producers in the United States continue to expand production per rig. US exports are increasing significantly.

- Qatar announced that it plans to increase output by 30 percent, which could be trouble for the US as Qatar is a low-cost producer.

- The United States remains the largest petroleum and natural gas producers in the world.

Now, for the inventory,

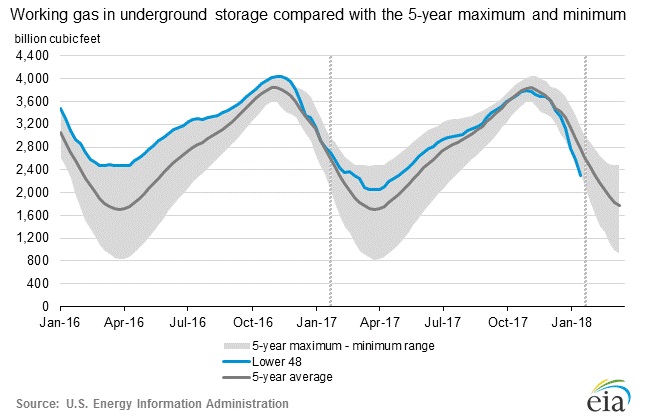

According to the latest numbers, working gas in the underground storage remains at 2.296 trillion cubic feet (Tcf). Stocks were 519 billion cubic feet (Bcf) than last year at this time and 486 Bcf below the five-year average. The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly changes in inventory.

- Last week, the inventory declined by 288 billion cubic feet against an expectation of 272 billion cubic feet drawdown. Today 102 billion cubic feet drawdown expected.

- EIA will release the inventory report at 15:30 GMT.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed