Natural gas is currently trading at $2.45 per MMBtu.

Key factors at play in the natural gas market –

- The price has succumbed to the broader downtrend, which is targeting $1.6 per MMBtu. Supply bottlenecks remain the main source of concern in the United States. This year due to excess natural gas supply while drilling for shale oil pushed the price to negative at the Permian basin, which recently became the highest producing field of the world.

- However, the price has jumped back after reaching $2.15 per MMBtu.

- The United States would become the biggest supplier of natural gas to Europe replacing Russia in the next 4 years, should president Trump gets re-elected to office.

- Lower global price acting as a key downside catalyst. Price in the UK declined to 34 pence per therm, down from record 84 pence. The price has jumped back after reaching 25 pence area.

Now, for the inventory,

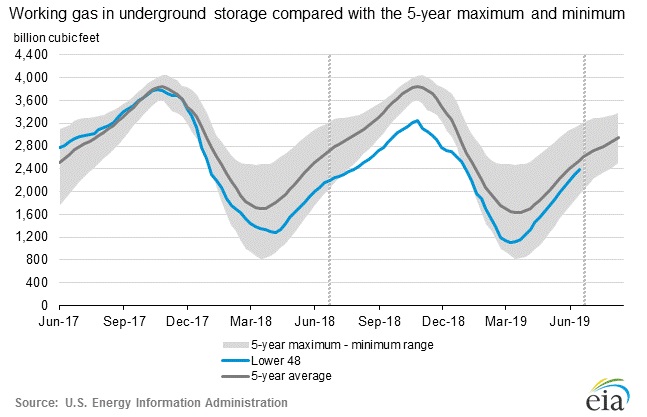

According to the latest numbers, working gas in the underground storage remains at 2.390 trillion cubic feet (Tcf). Stocks are 249 bcf higher less than last year, and 152 bcf below the five-year average. The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly changes in inventory.

- Last week, the inventory rose by 89 billion cubic feet against an expectation of 85 billion cubic feet build. Today 73 billion cubic feet build expected.

- EIA will release the inventory report at 14:30 GMT.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed