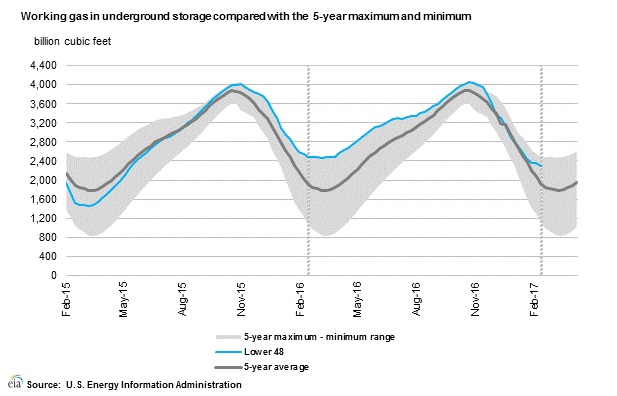

The production has declined over the course of 2016, but natural gas inventory had reached a record high of 4 trillion cubic feet in the same year, thanks to previous two week winters, which depleted less stock. This year, the winter in the United States was quite chilling but not sufficient to draw down this record inventory significantly. Hence we had to change our outlook in natural gas.

Our recent short call to sell natural gas at $3.14 has already reached two of the targets at $2.7 per MMBtu and $2.5 per MMBtu area. There is a strong possibility that gas price may decline to as low as $2 per MMBtu but that is not our base case at the moment. We have extended the short side target to as low as $2.3 per MMBtu. However, in last to last week’s report, we shared with our readers that we suspect that gas price would correct towards 2.9 per MMBtu and that would be the area to build short positions

In reality, the gas price went for a larger correction as the winter storm ‘Stella’ lowered temperature all across the United States and led to more than 3 feet of snow in areas around the East coast.

So, this week’s and also next week’s inventory reports are heavily crucial.

According to latest numbers, working gas in the underground storage remains at 2.295 trillion cubic feet. The chart from EIA shows the level of inventory. The second chart from investing.com shows weekly draws in inventory.

- Last week, the inventory draw was 64 billion cubic feet. Today it is expected that there will be a draw of 56 billion cubic feet.

- EIA will release the inventory report at 14:30 GMT.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed