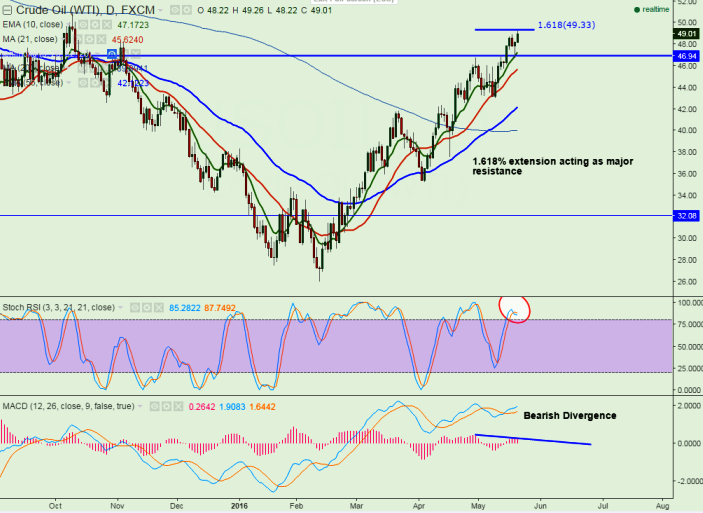

- Major resistance - $49.35 (161.8% retracement of 46.79 and 42.90)

- Major support - $46.70 (10 day MA)

- US oil has gained drastically after making a low of 46.72 yesterday. The commodity has broken $48.91 (18 the May High) today morning and jumped till $49.26.

- US crude should break above $49.35 for further up move .Any break above $49.35 will take the commodity to next level $50/$50.90 level.

- On the lower side minor support is around $48.70 and break below targets $48/$46.75.

- Daily MACD – Bearish Divergence

It is good to sell on rallies around $49.30-$49.35 with SL around $50 for the TP of $46.75