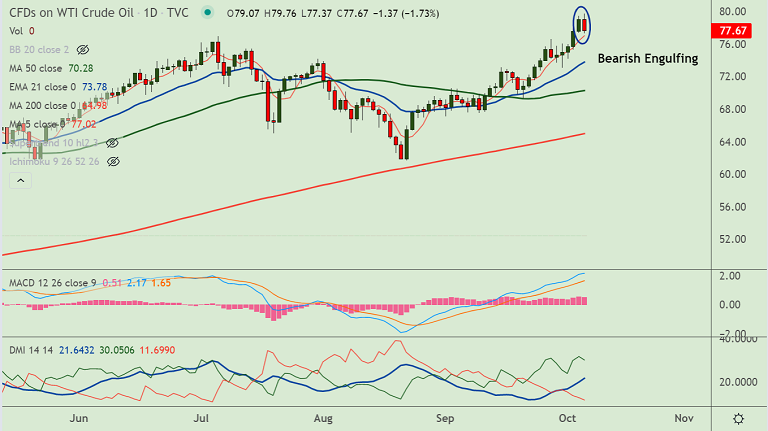

USOIL chart - Trading View

US oil prices have pared some gains and slipped lower from multi-year highs at $79.76 hit earlier in the day.

Inventories data published by the American Petroleum Institute (API) showed rising crude stocks in the United States, weighing on price.

API data showed the US crude oil inventories rose 0.951 million barrels in the week ended October 1st, after 6.108 million barrels declines in the previous week and as with market expectations of 4.127 million gains.

Technical studies point to chance for further downside in prices. Oscillators are at overbought levels.

Further, the daily candle shows a potential 'Bearish Engulfing' pattern, which if confirmed, raises scope for more downside.

US dollar dynamics also continue to influence WTI prices as markets await the crucial Non-Farm-Payrolls data (Friday).

5-DMA is immediate support at 77.03, while major support is seen at 21-EMA at 73.79.

Major trend is bullish. Pullbacks are likely to be shallow. Resumption of upside will see test of 88.85 levels.