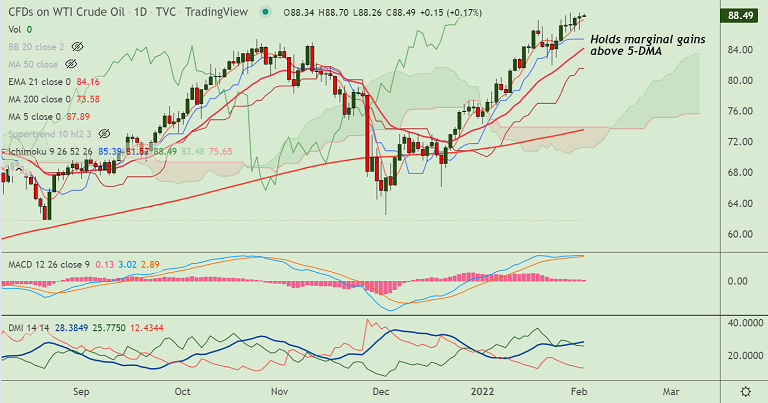

Chart - Courtesy Trading View

US Oil was holding marginal gains on the day and was trading 0.18% higher at $88.50 at around 04:55 GMT.

Data published by the American Petroleum Institute on Tuesday showed U.S. crude stocks fell by 1.6 million barrels for the week ended Jan. 28, against analysts' estimate of an increase of 1.5 million barrels.

Draw down in U.S. crude stocks confirmed strong demand and a lack of supply, supporting oil prices higher.

That said, investors remained cautious ahead of an OPEC+ meeting later in the day. Analysts expect OPEC+ to maintain its policy unchanged.

Technical analysis supports further upside in the pair. Oscillators are at overbought levels which might cause some pullbacks.

Major Support Levels:

S1: 87.89 (5-DMA)

S2: 86.27 (200H MA)

Major Resistance Levels:

R1: 89

R2: 90.57 (Upper BB)

Summary: Oil prices are consolidating near eight year highs. Overbought conditions may cause some pullbacks. Major trend however remains bullish.