The next upside target is 0.7130 (50% retracement of Feb/Mar decline).

NZDUSD’s medium term perspective: Potential for higher to the 0.7150-0.7300 area during the month ahead, as USD longs are pared. Further out, the Fed’s tightening cycle plus US fiscal expansion should maintain upside pressure on US interest rates and the US dollar, pushing NZDUSD down towards 0.6900 or lower. Weaker dairy prices plus the RBNZ’s emphatic reminders it is on hold for a long time should also weigh.

OTC Updates and Hedging Strategy:

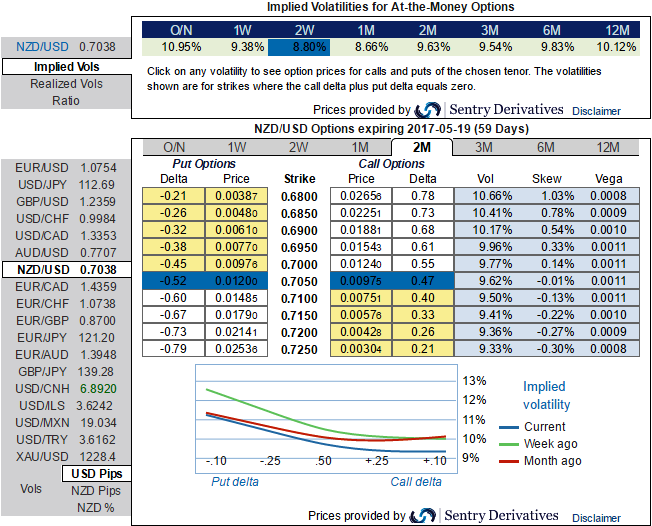

Please be noted that the implied volatility of at the money contracts of this APAC pair has been dropped below 9% for 2w expiry and shy above 9.6% for 2m tenors, while 2m vega contracts are signifying the hedgers’ interests in downside risks.

So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings in short run as the lower implied vols are conducive for option writers.

As the positively skewed IVs of 2m tenors and vega’s interest on OTM put strikes could be interpreted as the option holder’s opportunity in the medium run.

Weighing up above aspects, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1.5%) OTM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of long in 2m ATM +0.49 delta put options and 1 lot of (1%) ITM -0.61 delta put of 2m expiry.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure