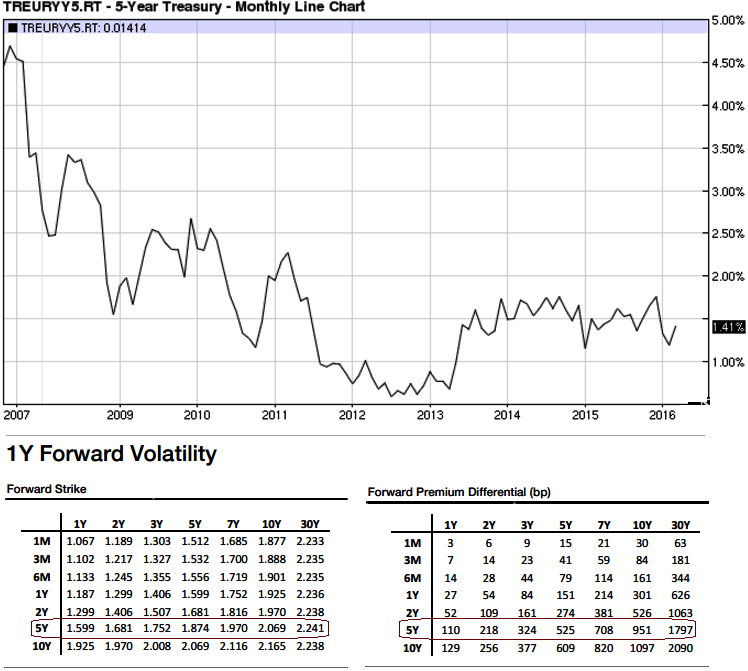

U.S.5Y treasury yield is flashing at 1.41% an increase from previous 1.38%, up about 2.61%.

14-day Real Strength - 55.11%

14-day Stochastic %K - 29.95%

14-day Stochastic %D - 35.61%

With 5yT yields down 15bp on the week, and 5s30s steepening by 8bp.

While WTI oscillating at $40 a barrel (3-months highs), and 5y breakevens continue to push higher into the 150 level. Expectations for the second hike were again pushed back to 2017.

On the grid, the left side led the underperformance on the dovish FOMC. Gamma was better offered with programme sellers hitting 1m-2m expiries, but pressure extending out to 6m.

With the FOMC meeting reinforcing the ranges, the bias near-term should be for lower volatility, Forward volatility (1y forward with vol triangles) Forward volatility continues to look slightly rich for short maturities, particularly on the left side of the grid, but elsewhere the grid looks cheap.

Hence, the recommendation goes this way, for long 1y forward 1y1y volatility (through a triangle go long in 2y1y and 1y1y straddles versus 1y2y straddles, equal notional, with strikes set to the 1y2y forward).