USDCAD has consolidated into a narrower 2.4% trading range since our last publication, but this belies what has been increasing signs of CAD underperformance on a broad-basis. On net USDCAD has risen less than a percent since we last published in mid-April.

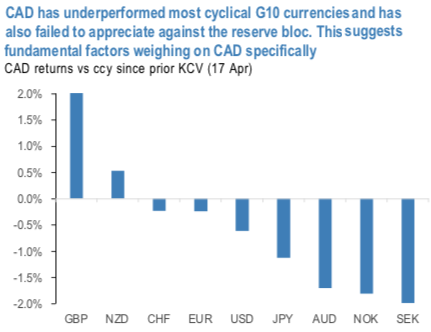

Yet in the G10 space, CAD has lagged both cyclical and reserve currencies (refer 1st chart). That CAD has not even outperformed the reserve bloc is indicative that CAD is not simply underperforming because of its inherently lower beta amid the recent modest relief rally, and is instead being dragged down by a mix of idiosyncratic fundamental factors, which we discuss below.

This behavior further solidifies our conviction that on a broad-basis, CAD will be one of the distinct underperformers in G10 FX this year.

Hence, we maintain our USDCAD forecasts of 1.48 by year-end and stay strategically short versus a defensive basket.

Bullish USDCAD Scenarios above 1.48 if:

1) the global sudden stop catalyzes a large capital outflow given Canada’s BoP deficits or

2) renewed oil price war accelerates industry-wide crude production shut-ins.

Bearish USDCAD Scenarios below 1.35 if:

1) the COVID-19 downturn is a true v-shaped recovery.

2) Central bank FX market intervention; A quicker than expected resolution of the Covid-19 crisis via comprehensive health solution (treatment & vaccine) allowing a quicker economic recovery.

USDCAD OTC Outlook And Options Strategy:

Given the above concerns, it makes sense that CAD has decoupled from oil from the recent weeks as the focus on Canada's specific weaknesses grows larger. Despite the move lower in USDCAD this week, we maintain that directionality from here is higher in the pair.

Hence, add longs in USDCAD via options contemplating above fundamental factors and below OTC indications:

The fresh negative bids to the existing bullish neutral risk reversal setup indicates the broader hedging sentiments for the upside price risks amid minor hiccups in the shorter tenors (refer 2nd chart).

To substantiate this stance, the positively skewed IVs of 3m tenors are indicating the upside (refer 3rd chart), bids for deep OTM call strikes up to 1.42 levels is interpreted as the hedgers are inclined for the upside risks.

Hence, at this juncture (spot reference: 1.37 levels), we upheld our shorts in CAD on hedging grounds via 3-month (1.3815/1.45) debit call spread. If the scenario outlined above unfolds, we will re-assess our stance but at the moment there are no changes to our CAD recommendations. Courtesy: Sentry, Saxo & JPM

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields